Marriott Bonvoy Bevy American Express Card Credit Card Overview

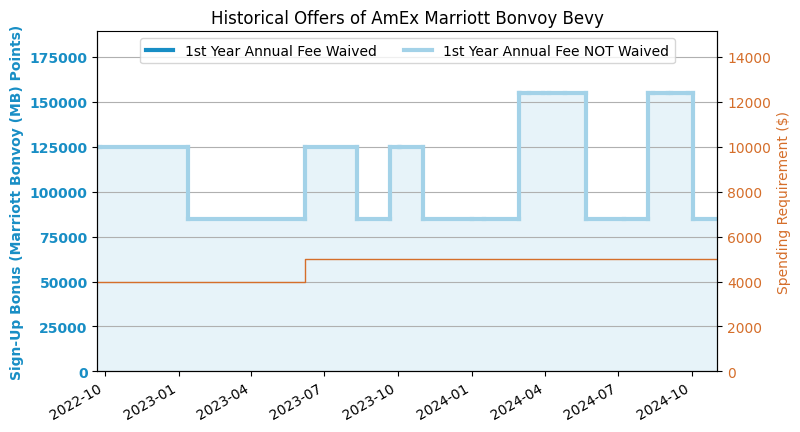

[Updated 2024.10] The high sign-up bonus is over, and now only the crappy offer of 85k is left.

[2024.8 Update] 155k sign-up bonus is back.

Application Link

feature

- 85k sign-up bonus: Earn 85,000 Marriott points after spending $5,000 or more within 6 months from account opening.The highest sign-up bonus recently is 155k.

- The points earned from this card are Marriott points, which we estimate to be 0.7 cents/point. Therefore, the 155k sign-up bonus is worth about $1,085.

- You can earn 6x Marriott Points for spending at Marriott hotels, 4x points for the first $15k spent at supermarkets and restaurants each year, and 2x for other spending.

- Cardholders can earn an additional 1,000 bonus points for each eligible stay at Marriott hotels. Qualified stays refer to stays booked on the official website or through a travel agent. Third-party websites (such as Priceline/Expedia) do not count as qualified stays.

- Each Marriott account can receive up to 15 elite night credits from One The number of qualifying nights for a personal co-branded credit card, even if you hold multiple cards (the one with the most bonuses counts). If you have a business Marriott card, you can get an additional 15 nights.

- Free with card Marriott Gold Membership.

- Spend $15k or more each year and get a 50k Free Night at Marriott.

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- No Foreign Transaction Fee (FTF).

shortcoming

- Annual fee is $250. [Friendly reminder] The annual fees of all credit cards are not included in the card opening consumption task!

- There is no free night every year. You need to spend $15k to get a 50k FN.

Introduction to Marriott Points

- Marriott points are the most flexible points (after Marriott merged with SPG and inherited its huge number of airline partners).

- The main credit cards that can earn Marriott points are:Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold, AmEx Marriott Bonvoy Brilliant, AmEx Marriott Bonvoy Business, and cards that are no longer available but can still be obtained through card transfer: Chase Ritz-Carlton, and AmEx Marriott Bonvoy.

- Marriott points are stored in your Marriott account, not on your card, so closing your account will not result in a loss of points.

- If there is no money in or out of your Marriott account within 24 months, your Marriott points will expire. As long as you earn points by swiping your card or staying in a hotel, or redeem points during this period, you can postpone the expiration date of your points.

- Marriott points can be converted to a lot of airline miles (no need to hold a Marriott-related credit card), with a conversion ratio of 3:1.25 (i.e. 3:1 conversion, plus 5k miles for every 60k Marriott points converted). The recommended miles are:Alaska Airlines(AS)(Non-Alliance),Japan Airlines(JL)(Universe),United Airlines (UA)(Star Alliance),American Airlines(AA)(Universe),All Nippon Airways(ANA, NH)(Star Alliance),Korean Air (KE)(SkyTeam), etc. If you use Marriott points this way, the value of Marriott points is about 0.7 cents/point.

- Marriott points can also be redeemed at its own hotels (including hotels under Marriott/Ritz-Carlton/SPG). Marriott Exchange ChartGenerally speaking, it is most cost-effective to redeem points at hotels with the lowest category (more common in China, less common in the United States). If you use Marriott points in this way, the value is about 0.7 cents/point.

- In summary, we estimate Marriott’s point value to be approximately 0.7 cents/point.

Recommended application time

- [Limited to once in a lifetime for the same card] You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- 【New】【Same series restrictions】AmEx has begun to gradually limit the sign-up bonuses of the same series of cards: high annual fee cards will affect low annual fee cards. Specifically, if you have opened a Marriott Brilliant with a high annual fee, it will affect the sign-up bonus of the Marriott Bevy with a low annual fee. So if you want to get both, it is recommended to open the Marriott Bevy first.

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- If you meet any of the following conditions, you will not be able to get the sign-up bonus:

- Currently holding, or have held within 30 days:Chase Ritz-Carlton, Chase Marriott Bonvoy Bountiful, Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold, Chase Marriott Old Card, Chase Marriott Business Card Old Card;

- Have acquired within 90 days (i.e., obtained through application or card transfer, not whether currently in possession):Chase Marriott Bonvoy Bountiful, Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold;

- Received a sign-up bonus or upgrade bonus within 24 months:Chase Marriott Bonvoy Bountiful, Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold.

For details on the mutual restrictions between Marriott Bonvoy co-branded cards, please refer toMarriott Bonvoy co-branded card sign-up bonus restriction policy summary and application strategy》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

- A maximum of 2 credit cards can be approved within 90 days. Charge cards are not subject to this rule. Cards approved on the same day will have their Hard Pulls combined.

- You can hold up to 5 AmEx credit cards and up to 10 charge cards at the same time.

Summarize

A card with an annual fee of $250 doesn't even give free FN? As a cardholder, I feel insulted when I see this kind of card. The only unique benefit is the extra 1,000 points per stay (about $7). Unless you have a lot of needs, staying extra for the benefit is actually a counter-exploitation. What other value is there in holding this card besides the sign-up bonus? Right now, there is only a sign-up bonus based on pure points. If there is a higher bonus in the future, or if you sign up for a large amount of points + FN, you can consider taking a sign-up bonus. But pay attention to the current restrictions on Marriott cards. You won't be able to "take it all" from Amex/Chase in the short term.

Related credit cards

- Chase Marriott Bonvoy Bold

- Chase Marriott Bonvoy Boundless

- Chase Marriott Bonvoy Bountiful

- Chase Ritz-Carlton

- AmEx Marriott Bonvoy

- AmEx Marriott Bonvoy Business

- AmEx Marriott Bonvoy Bevy (this article)

- AmEx Marriott Bonvoy Brilliant

| Chase Marriott Bonvoy Bold | Chase Marriott Bonvoy Boundless | Chase Marriott Bonvoy Bountiful | Chase Ritz-Carlton | AmEx Marriott Bonvoy | AmEx Marriott Bonvoy Business | AmEx Marriott Bonvoy Bevy | AmEx Marriott Bonvoy Brilliant | |

|---|---|---|---|---|---|---|---|---|

| Annual Fee | $0 | $95 | $250 | $450 | $95 | $125 | $250 | $650 |

| Various Credit | none | none | none | $300 airline incidental credit | none | none | none | $25*12 dining credit |

| Free Night | none | up to 35k | none | up to 85k | up to 35k | up to 35k | none | up to 85k |

| Marriott Membership | Silver | Silver | Gold | Gold | Silver | Gold | Gold | Platinum |

| Elite Nights | 15N | 15N | 15N | 15N | 15N | 15N (extra) | 15N | 25N |

| Best welcome offer | 60k | 100k | 125k | Can't apply directly | Can't apply directly | 100k | 125k | 150k |

Best downgrade option

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart