Marriott Bonvoy Brilliant American Express Card (formerly Starwood Preferred Guest American Express Luxury Card) Credit Card Overview

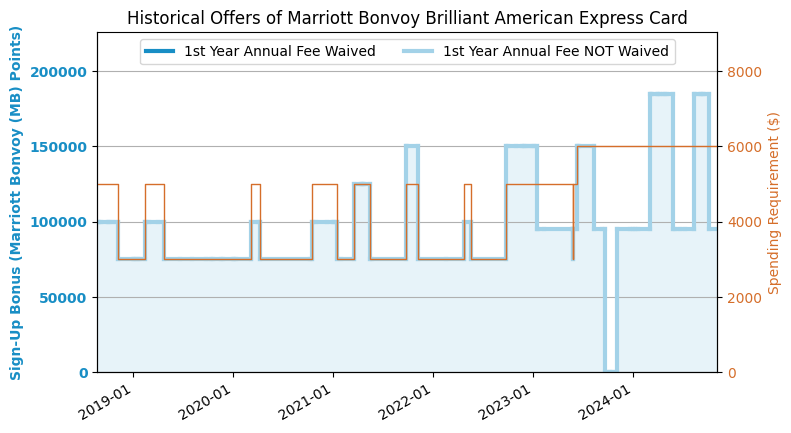

[Updated 2024.10] The high sign-up bonus has expired, and now there is only a crappy offer of 95k.

[2024.8 Update] The 185k sign-up bonus is back.

Application Link

feature

- 95k sign-up bonus: Earn 95,000 Marriott points after spending RMB$6,000 or more within 3 months after account opening.The highest sign-up bonus recently is 150k + 85k FN.

- The points earned from this card are Marriott points (because SPG has now been officially merged into Marriott), and we estimate it to be 0.7 cents/point. Therefore, its 185k sign-up bonus is worth about $1,295.

- You can earn 6x Marriott Points when you spend at Marriott hotels, 3x when you spend at restaurants and airlines, and 2x when you spend on other items.

- 【New】$25 in food and beverage reimbursement per month, $300 per year in total. This replaces the previous $300 per year Marriott hotel reimbursement.

- 【New】25 elite night credits every calendar year (note: elite nights are used to calculate membership level, generally called qualifying nights, not free nights). Each Marriott account can receive a maximum of One The number of qualifying nights for a US personal co-branded credit card is calculated based on the card with the most nights. If you have a business Marriott card, you can get another 15 nights.

- 【New】Free gift for cardholders Marriott Platinum Membership.

- 【New】Starting from the second year, you will receive one free night after paying the annual fee, which can be used at Marriott Bonvoy hotels with 85k points or less.

- 【New】Starting from January 1, 2023: Every calendar year, if you spend $60k or more, you can choose one of the following 3 benefits:

- 5 Suite Night Awards (Suite Vouchers)

- Mattress and Box Spring $750 Discount

- 85k Free Night Award (I think everyone will choose this)

- When you book a Luxury Credit Card Rate at Ritz-Carlton or St. Regis, you can enjoy $100 on-property credit.But it is better to choose Marriott STARS program than to book this package. For details, see《Introduction to Marriott STARS & LUMINOUS》.

- Cardholders will receive a separate Priority Pass Select (PPS) The card can be used in many lounges around the world (including China), such as the first-class lounges of Air China and other airlines in Beijing. The PPS card given with this card can bring up to 2 companions for free, and additional people are charged at $27/person. Please note that the PPS card given with the AmEx card can only enter the airport lounges that cooperate with PPS for free, but not the restaurants that cooperate with PPS. Click hereenroll.

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can be reimbursed Global Entry ($100) or TSA Pre✓ ($85). Global Entry is a fast track for US Customs, and TSA Pre✓ is a fast track for security screening at US domestic airports. Only US citizens or green card holders can apply for them.

- Metal card.

- No Foreign Transaction Fee (FTF).

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can earn 20k Marriott points for each successful application, up to a cap of 55k/calendar year.

shortcoming

- [New] Annual fee $650, first year annual fee not waived. [Friendly reminder] Annual fees of all credit cards are not included in the card opening consumption task!

Introduction to Marriott Points

- Marriott points are the most flexible points (after Marriott merged with SPG and inherited its huge number of airline partners).

- The main credit cards that can earn Marriott points are:Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold, AmEx Marriott Bonvoy Brilliant, AmEx Marriott Bonvoy Business, and cards that are no longer available but can still be obtained through card transfer: Chase Ritz-Carlton, and AmEx Marriott Bonvoy.

- Marriott points are stored in your Marriott account, not on your card, so closing your account will not result in a loss of points.

- If there is no money in or out of your Marriott account within 24 months, your Marriott points will expire. As long as you earn points by swiping your card or staying in a hotel, or redeem points during this period, you can postpone the expiration date of your points.

- Marriott points can be converted to a lot of airline miles (no need to hold a Marriott-related credit card), with a conversion ratio of 3:1.25 (i.e. 3:1 conversion, plus 5k miles for every 60k Marriott points converted). The recommended miles are:Alaska Airlines(AS)(Non-Alliance),Japan Airlines(JL)(Universe),United Airlines (UA)(Star Alliance),American Airlines(AA)(Universe),All Nippon Airways(ANA, NH)(Star Alliance),Korean Air (KE)(SkyTeam), etc. If you use Marriott points this way, the value of Marriott points is about 0.7 cents/point.

- Marriott points can also be redeemed at its own hotels (including hotels under Marriott/Ritz-Carlton/SPG). Marriott Exchange ChartGenerally speaking, it is most cost-effective to redeem points at hotels with the lowest category (more common in China, less common in the United States). If you use Marriott points in this way, the value is about 0.7 cents/point.

- In summary, we estimate Marriott’s point value to be approximately 0.7 cents/point.

Recommended application time

- You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- If you meet any of the following conditions, you will not be able to get the sign-up bonus:

- Currently holding, or have held within 30 days:Chase Ritz-Carlton;

- Have acquired within 90 days (i.e., obtained through application or card transfer, not whether currently in possession):Chase Marriott Bonvoy Bountiful, Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold;

- Received a sign-up bonus or upgrade bonus within 24 months:Chase Marriott Bonvoy Bountiful, Chase Marriott Bonvoy Boundless, Chase Marriott Bonvoy Bold.

For details on the mutual restrictions between Marriott Bonvoy co-branded cards, please refer toMarriott Bonvoy co-branded card sign-up bonus restriction policy summary and application strategy》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

- A maximum of 2 credit cards can be approved within 90 days. Charge cards are not subject to this rule. Cards approved on the same day will have their Hard Pulls combined.

- You can hold up to 5 AmEx credit cards and up to 10 charge cards at the same time.

Summarize

This card has been greatly enhanced after the revision in September 2022, but at the same time the annual fee has also become much higher. The most direct benefit is that cardholders will receive Marriott Platinum membership. Marriott Platinum status comes with breakfast benefits, and you no longer have to work hard to book a room. Holders of this card will receive 25N qualifying nights. If you add the 15N for business cards, then Marriott's nights per year will start from 40N, and titanium (requiring 75N) will not be far away. However, the annual fee of $650 after the revision is really too high. The dining reimbursement has become $25 per month, which is definitely more difficult to use. Even at a discount, it is only worth $200. That is equivalent to an annual fee of $450 to buy an 85k FN and Platinum membership + 10N (this card gives 25N but other Marriott personal cards also have 15N). This routine is different. AmEx Hilton Aspire Almost, but the equivalent annual fee is still much higher than Aspire. The free Marriott Platinum benefits can only be used when you actually stay at the hotel, so this card will be more suitable for people who have certain travel needs within a year and prefer Marriott.

Related credit cards

- Chase Marriott Bonvoy Bold

- Chase Marriott Bonvoy Boundless

- Chase Marriott Bonvoy Bountiful

- Chase Ritz-Carlton

- AmEx Marriott Bonvoy

- AmEx Marriott Bonvoy Bevy

- AmEx Marriott Bonvoy Business

- AmEx Marriott Bonvoy Brilliant (this article)

| Chase Marriott Bonvoy Bold | Chase Marriott Bonvoy Boundless | Chase Marriott Bonvoy Bountiful | Chase Ritz-Carlton | AmEx Marriott Bonvoy | AmEx Marriott Bonvoy Business | AmEx Marriott Bonvoy Bevy | AmEx Marriott Bonvoy Brilliant | |

|---|---|---|---|---|---|---|---|---|

| Annual Fee | $0 | $95 | $250 | $450 | $95 | $125 | $250 | $650 |

| Various Credit | none | none | none | $300 airline incidental credit | none | none | none | $25*12 dining credit |

| Free Night | none | up to 35k | none | up to 85k | up to 35k | up to 35k | none | up to 85k |

| Marriott Membership | Silver | Silver | Gold | Gold | Silver | Gold | Gold | Platinum |

| Elite Nights | 15N | 15N | 15N | 15N | 15N | 15N (extra) | 15N | 25N |

| Best welcome offer | 60k | 100k | 125k | Can't apply directly | Can't apply directly | 100k | 125k | 150k |

Best downgrade option

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart