American Express Gold Card (formerly Premier Rewards Gold)

【2024.7 Update】This card has been updated with new benefits, such as Previous notice Like:

- The annual fee has increased from $250 to $325.

- New benefits $84 Dunkin' credit: $7 per month Dunkin' credit, need to enroll.

- New benefit $100 Resy credit: $50 every six months Resy credit (limited to the United States), enrolment is required.

- The monthly $10 credit for dining will be cancelled from September 25, 2024, and Five Guys will be added (only in the United States), effective immediately.

- There was no upper limit on the points you can earn for 4x dining before, but now it is capped at $50k per year.

- You can choose the limited edition White Gold card design, and existing users can also replace it with a new card design. This name is very confusing. Theoretically, AmEx Platinum should be translated into "Platinum Card", and White Gold is "Platinum".

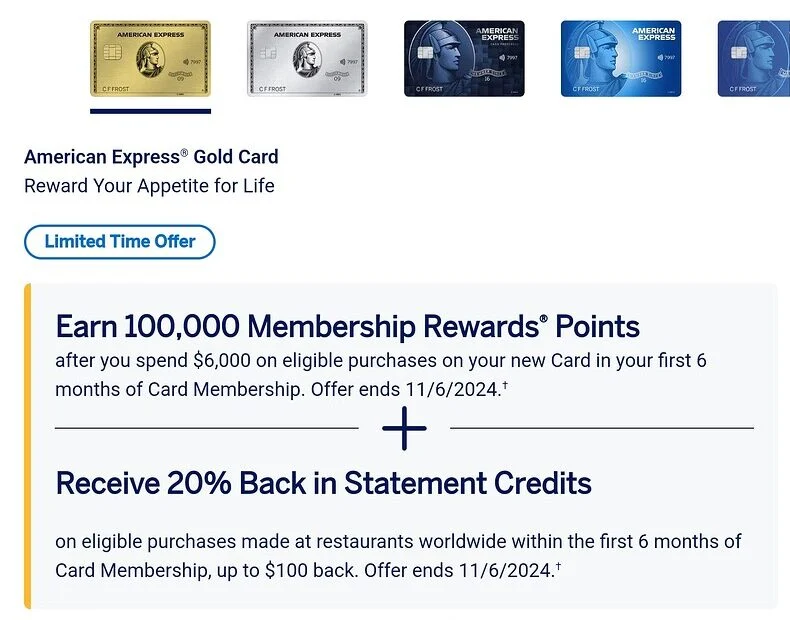

- The new sign-up bonus can be as high as 100k+$100 in stealth mode (HT: US Card Forum KaitingZ), but it is more difficult to get, 90k+$100 is a little easier to get. 11.6 expired.

This revision is a typical one with increasing annual fees and coupon books, especially the monthly credit which is disgusting. I wonder how many people decided to quit after this wave of changes?

Application Link

feature

- 100k+$100 sign-up bonus: Earn 100,000 Membership Rewards (MR) points after spending $6,000 within 6 months of account opening, and earn 20% back up to $100 back for dining in the first 6 months of account opening.This is the highest sign-up bonus for this card.

- The points earned from this card are Membership Rewards (MR), which we estimate to be 1.6 cents/point. See below for a brief introduction. Therefore, the highest sign-up bonus of 100k+$100 is worth about $1,700!

- You can earn 4x MR on dining (worldwide); 4x MR on supermarkets (within the United States); 3x MR on flights booked directly on the airline’s official website; 1x on other purchases.

- The 4x points earned on dining is limited to the first $50,000 dining expenses per calendar year, which is basically unlimited for many people. The 4x points earned on supermarkets is limited to the first $25,000 supermarket expenses per calendar year, which is basically unlimited for many people.

- $120 Uber credit: Get $10 Uber credit every month. Just add this card to your Uber or Uber Eats account.

- $120 dining credit: $10 dining credit per month, which can be used for Grubhub, Seamless, The Cheesecake Factory, Wine.com, Goldbelly, Five Guys. You need to enroll and use this card to pay.Here is the enroll link.

- 【New】$84 Dunkin' credit: get $7 every month Dunkin' credit, need to enroll.

- 【New】$100 Resy credit: Get $50 every six months Resy Resy is available in the United States. You can pay with AmEx Gold at any Resy-affiliated hotel without having to make a reservation with Resy.

- No Foreign Transaction Fee (FTF).

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can earn 10k MR points for each successful application, up to a cap of 55k / calendar year.

- The application is easy because strictly speaking it is a charge card rather than a credit card. Charge card means that you cannot just pay the minimum payment, but must pay off the full balance before each due date. Please note that there will also be a hard pull when applying for a charge card, just like a credit card.

- Charge Cards have no pre-set spending limit.

shortcoming

- 【New】Annual fee is $325, and the first year annual fee is not waived.

- There is no charge for adding the first 5 additional cards, but starting from the 6th card, there is an annual fee of $35 for each card.

- The dining credit and Uber credit given every month will expire if not used that month, and cannot be saved up and used all at once.

- Supermarket 4x is only available within the United States.

Introduction to MR Points

- The main credit cards that can earn MR points are:AmEx ED, AmEx EDP, AmEx Green, AmEx Gold, AmEx Platinum, AmEx Platinum for Schwab, AmEx Platinum for Morgan Stanley, AmEx Blue Business Plus, AmEx Business Green, AmEx Business Gold, AmEx Business Platinum etc.

- The MR points accumulated from each MR card are automatically accumulated to the same MR account.

- MR points never expire. Closing a card will not cause the MR points accumulated on that card to disappear, but if you close all MR cards, all MR points will disappear. In order to avoid the loss of MR points, it is recommended that you hold a no-annual-fee card for a long time. AmEx ED.

- If you hold any MR card, you can convert MR into some airline miles. The most common and cost-effective way to use MR is to convert 1:1 into All Nippon Airways (ANA, NH) Miles (Star Alliance). Other recommended miles include: Air Canada(AC)(Star Alliance),Delta Air Lines(DL)(Trina),British Airways(BA)(Universe),Cathay Pacific Asia Miles(Universe),Singapore Airlines(SQ)(Star Alliance),Air France-KLM Flying Blue(Trina),Virgin Atlantic (VS)(Non-alliance) etc. If used this way, the points are worth about 1.6 cents/point.

- Holders of any MR card can directly redeem points at a fixed value of about 1 cent/point on AmEx travel portal Book your flight online.

- In holding AmEx Platinum for Schwab If you have the MR points card, you can redeem them at a fixed rate of 1.1 cents/point. If you don’t like to study miles, this is a good option. If you don’t have this card, you can only redeem MR points at a fixed rate of 0.6 cents/point.

- In summary, we estimate the value of MR points to be approximately 1.6 cents/point.

- For more information on the MR Points system, seeMaximize the value of your credit card points” (review) andHow to earn MR points》《MR Points Usage》(Super detailed).

Recommended application time

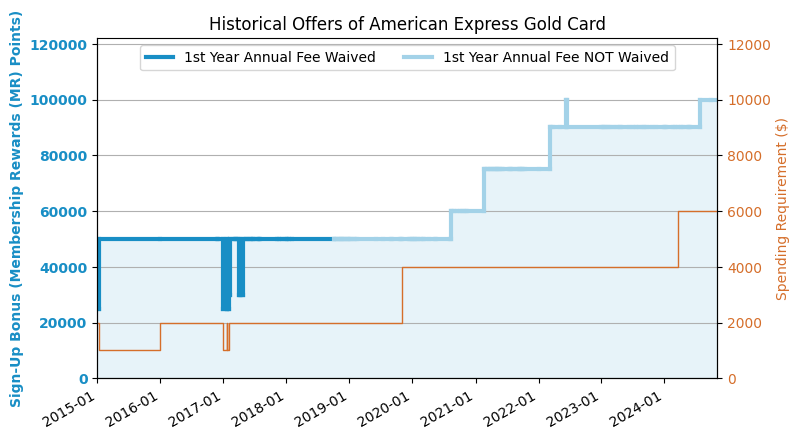

- [Limited to once in a lifetime for the same card] You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- 【New】【Same series restrictions】AmEx has begun to gradually limit the sign-up bonuses of the same series of cards: the high annual fee will affect the low annual fee. Specifically, if you have opened a Platinum card with a high annual fee, it will affect the sign-up bonus of the Gold card with a low annual fee, so if you want to get both, it is recommended to open a Gold card first.

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

Summarize

This card has a high sign-up bonus, so it is definitely worth applying for it. The 4x rebate at restaurants and supermarkets is the strength of this card. If you spend a lot in these two categories, this card is very useful. After the latest revision in 2024, this card has an annual fee of up to $325. There are many credits that expire every month. Although the face value is not low, it is too difficult to use. The actual value should be at least 50% off. If you can use up various reimbursements naturally, you can consider holding it for a long time, otherwise it is very painful to swipe this coupon book specifically.

Best downgrade option

- This card cannot be downgraded to a no annual fee card, so it is recommended to close it directly if you don’t want to keep it.

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart