Wyndham Rewards® EarnerSM Card Wyndham Hotels (nicknamed "Auntie Wen") Credit Card Introduction

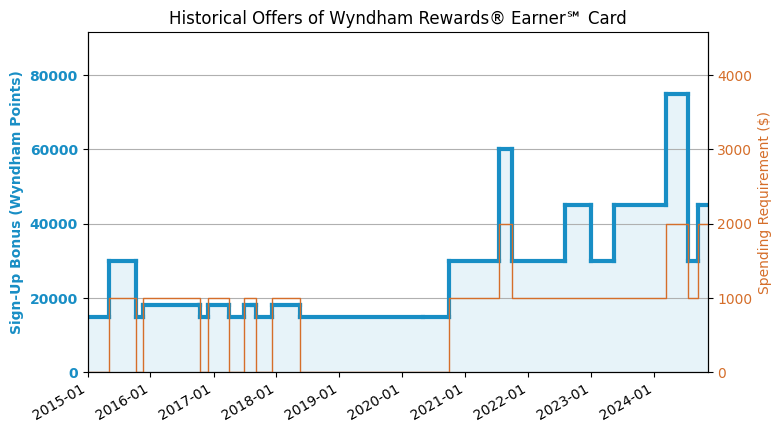

[2024.9 Update] 45k sign-up bonus is back.

[Updated 2023.8] The high sign-up bonus has expired, and now there is only a crappy offer of 30k.

[2024.3 Update] The new sign-up bonus is 75k, a record high!

Application Link

feature

- 45k sign-up bonus: Earn 45,000 Wyndham Points after spending $2,000 or more within 180 days from account opening.The highest sign-up bonus recently is 75k.

- Wyndham Points are worth about 1.0 cents/point (Hotel Points Valuation). In fact, Wyndham's hotel redemption structure is very simple, with only three levels: 7.5k/15k/30k. For details, please refer to "Wyndham Rewards Frequent Traveler Program Overview” Therefore, its highest sign-up bonus of 75k is worth about $750!

- “go free "Faster": Cardholders can reduce the points required for redemption by 10%, which means that redemptions at three tiers of hotels only require 6.75k/13.5k/27k points respectively.

- Earn 5x Wyndham Points on purchases at Wyndham hotels and gas, 2x Wyndham Points on dining and grocery stores, and 1x on all other purchases.

- Every anniversary year, you can earn 7,500 points for every $15,000 spent.

- Automatically obtain Wyndham Gold Member.

- No Foreign Transaction Fee (FTF).

- No annual fee.

shortcoming

- Because Wyndham's hotels are generally not of high quality, the free nights may not provide particularly high value.

- It must be noted that Wen's points will expire, even if there are activities. In the case of inactive, it will expire after 18 months, and even if there are activities, the points will expire after four years. Therefore, if you don't plan to stay in the hotel in the next few years, it is not suitable to hoard this point.

Recommended application time

- Barclays places great emphasis on recent Hard Pulls and recommends applying when the number of Hard Pulls within 6 months is less than 6, although this is not a strict rule.

- [6/24 rule] Similar to Chase’s 5/24 rule, Barclays will also reject you if you have 6 or more new accounts within 24 months. However, unlike Chase, Barclays’ rule is not strictly enforced and there are often counter-examples.

- It is recommended that you apply after having a credit history of more than one year.

- Theoretically, only Permanent Residents (green card holders or citizens) can apply for Barclays credit cards. The screenshot below is from the application details. In fact, the bank does not really verify whether you are a green card holder or citizen. Non-green card holders can also apply, but at their own risk.

Summarize

We recommend applying for the annual fee version Barclays Wyndham Earner Plus Get a higher sign-up bonus, and then downgrade to the no annual fee version when you no longer need accommodation. The no annual fee version still has point redemption discounts and hotel discounts, which is quite conscientious.

Related credit cards

- Barclays Wyndham Earner Plus

- Barclays Wyndham Earner (this article)

- Barclays Wyndham Earner Business

| Barclays Wyndham Earner | Barclays Wyndham Earner Plus | Barclays Wyndham Earner Business | |

|---|---|---|---|

| Annual Fee | $0 | $75 | $95 |

| Annual Points | 7,500 (if spending $15,000 or more) | 7,500 | 15,000 |

| Bonus Categories | Earn 5 points per $1 spent on eligible purchases made at Hotels By Wyndham as well as on qualifying gas purchases; Earn 2 points per $1 spent on eligible dining and grocery purchases (excluding Target and Walmart) | Earn 6 points per $1 spent on eligible purchases made at Hotels By Wyndham as well as on qualifying gas purchases; Earn 4 points per $1 spent on eligible dining and grocery purchases (excluding Target and Walmart) | Earn 8 points per $1 spent on eligible purchases made at Hotels By Wyndham as well as on qualifying gas purchases; Earn 5 points per $1 spent on eligible marketing, advertising services, and utilities |

| Wyndham Elite Membership | Gold | Platinum | Diamond |

| Best Sign-up Bonus | 60,000 | 90,000 | 90,000 |

After applying

- Barclays can check the status of your application Click here.

- Barclays reconsideration backdoor number: 866-408-4064. Barclays will like to ask you various questions in detail, so you must be confident about your personal situation and credit report. In addition, their reconsideration is likely to hard pull again, but they will also inform you in advance, so you can use your own discretion.

Sign-up bonus trend chart

Application Link

END