Barclays Emirates Skywards Premium World Elite Mastercard® Credit Card Overview

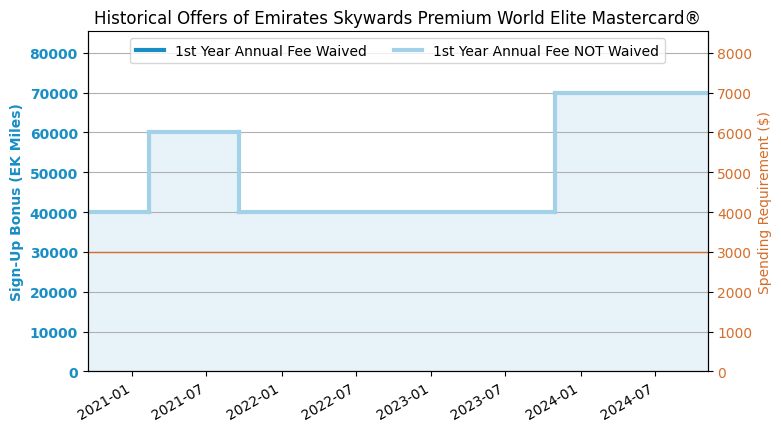

[Update 2023.10] A record high sign-up bonus of 70k has appeared.

[Updated 2021.9] The 60k sign-up bonus has expired. Currently, there is only a 40k regular sign-up bonus.

[Updated in February 2021] This card has a new sign-up bonus today. You can get 60,000 miles by spending $3000 within 90 days of opening the card.

Application Link

feature

- 70k sign-up bonus: Earn 70,000 EK Miles after spending $3,000 or more within 90 days of account opening.This is the highest sign-up bonus for this card.

- The EK Miles earned with this card are worth about 1.2 cents/mile (reference Airline Miles Valuation). Therefore, the maximum sign-up bonus of 70k is worth about $840. For details on how to use EK miles, please refer to "EK Miles Redemption Guide》.

- You can earn 3x EK Miles on purchases at EK (Emirates), 2x points on hotels, car rentals and other airline purchases, and 1x on all other purchases.

- After spending $30k per year, you will get an extra 10k miles.

- In the first year of cardholding, you will be given Emirates Gold membership (Gold cardholders can enjoy free access to EK Global Business Class Lounge), and you will need to spend $40k per year to maintain your membership.

- Cardholders will receive a separate Priority Pass Select (PPS) Card (will be sent to you automatically after activation), you can bring 2 people for free. You can use it in many lounges around the world (including China), such as the first class lounges of Air China and other airlines in Beijing. The secondary card holder will also have his own separate PPS card.

- This card can be reimbursed Global Entry or TSA Pre✓ ($100). Global Entry is a fast track for US Customs, and TSA Pre✓ is a fast track for security screening at US domestic airports. Only US citizens or green card holders can apply for them.

- EK miles do not expire during the card period.

- No Foreign Transaction Fee (FTF).

shortcoming

- The annual fee is $499, and the first year's annual fee is not waived.

- The sign-up bonus is too low.

Recommended application time

- Barclays places great emphasis on recent Hard Pulls and recommends applying when the number of Hard Pulls within 6 months is less than 6, although this is not a strict rule.

- [6/24 rule] Similar to Chase’s 5/24 rule, Barclays will also reject you if you have 6 or more new accounts within 24 months. However, unlike Chase, Barclays’ rule is not strictly enforced and there are often counter-examples.

- It is recommended that you apply after having a credit history of more than one year.

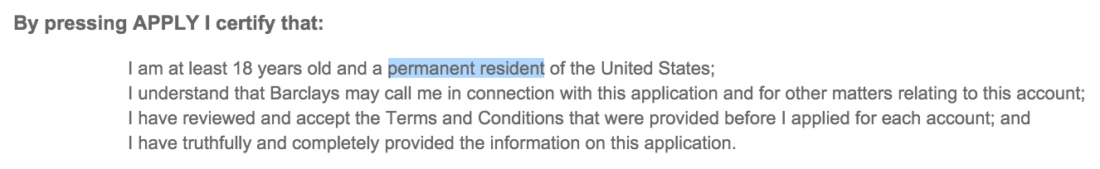

- Theoretically, only Permanent Residents (green card holders or citizens) can apply for Barclays credit cards. The screenshot below is from the application details. In fact, the bank does not really verify whether you are a green card holder or citizen. Non-green card holders can also apply, but at their own risk.

Summarize

The current sign-up bonus is too unattractive. I feel that the biggest benefit of this card is that it gives you Gold Membership in the first year, which is equivalent to buying it. After that, you need to spend a lot of money every year to maintain it. If you often fly EK, it is worth considering. But can't you get the membership directly if you often fly EK? In short, I think this card is very average...

Related credit cards

- Barclays Emirates Skywards Rewards

- Barclays Emirates Skywards Premium (this article)

Best downgrade option

- Barclays Emirates Skywards RewardsIn fact, if you don't want it anymore, just close it. Downgraded cards also have annual fees.

After applying

- Barclays can check the status of your application Click here.

- Barclays reconsideration backdoor number: 866-408-4064. Barclays will like to ask you various questions in detail, so you must be confident about your personal situation and credit report. In addition, their reconsideration is likely to hard pull again, but they will also inform you in advance, so you can use your own discretion.

Sign-up bonus trend chart