Luxury Card MasterCard Black Card Credit Card Overview

Application Link

feature

- This card weighs 22g. The heaviest credit card an average person can apply for.

- Earn 1x points on all purchases.

- These points can be redeemed for air tickets at a fixed rate of 2 cents/point, or for cash at a fixed rate of 1.5 cents/point.

- Cardholders will receive a separate Priority Pass Select (PPS) The card can be used in many lounges around the world (including China), such as the first-class lounges of Air China and other airlines in Beijing.

- Each calendar year, you can reimburse $100 of aviation-related expenses (including the airfare itself!).

- This card can be reimbursed Global Entry ($120). Global Entry is a fast track for US Customs and can only be applied by US citizens or green card holders.

- Mobile phone insurance: The annual limit is $1,000. The insurance covers theft and damage. Just use this card to pay for your mobile phone bill.

- No Foreign Transaction Fee (FTF).

- Luxury Gifts: Surprise gifts. We cannot know in advance what kind of gifts they will give and when they will be given. For exampleThe gift everyone received in 2016 was a Cross fountain pen.

shortcoming

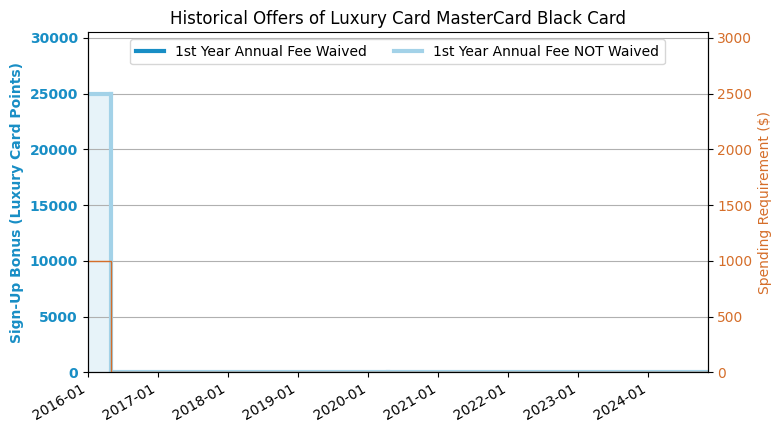

- $495 annual fee, first year annual fee not waived.

- There is currently no sign-up bonus for this card.

Recommended application time

- Barclays places great emphasis on recent Hard Pulls and recommends applying when the number of Hard Pulls within 6 months is less than 6, although this is not a strict rule.

- It is recommended that you apply after having a credit history of more than one year.

Summarize

First of all, I want to emphasize that although the name of this card is Black Card, this card is not what people often call a black card! American Express Black Card AmEx Centurion.

The annual fee for this card is really too high. Chase Sapphire Reserve (CSR), AmEx Platinum, Citi Prestige, Chase Ritz-Carlton The annual fee is in the range of $450~$550, which is basically half of it. Its rebate structure is 2% return for all consumption (if used to exchange for air tickets). The advantage is that it is relatively brainless and does not require time to study how to maximize the value. Citi Double Cash Similar (Citi Double Cash gives real cash back and does not require specific use).If you are a serving member of the US military, Barclaycard can waive your annual fee.If you are a serving member of the US military or a wealthy person, you can still consider this card. Otherwise, there is no need to apply for it.

Related credit cards

- Luxury Card MasterCard Titanium Card

- Luxury Card MasterCard Black Card

(This article)

- Luxury Card MasterCard Gold Card

After applying

- Barclays can check the status of your application Click here.

- Barclays reconsideration backdoor number: 866-408-4064. Barclays will like to ask you various questions in detail, so you must be confident about your personal situation and credit report. In addition, their reconsideration is likely to hard pull again, but they will also inform you in advance, so you can use your own discretion.

Sign-up bonus trend chart