Barclays Upromise Mastercard Credit Card Introduction

[Update 2019.1] This card was removed in 2017.3, but it is back after a revamp. It is a terrible card after the revamp.

Application Link

feature

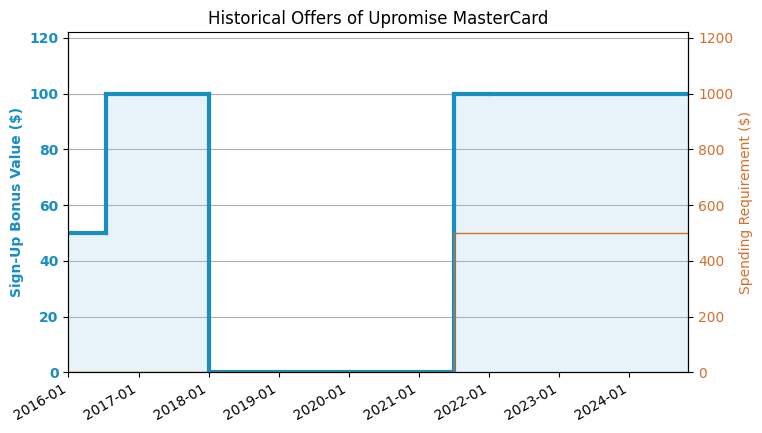

- $100 sign-up bonus: You can get $100 bonus after spending $500 within 90 days of opening the card.

- 1.25% cashback on all purchases.

- If you connect your Upromise Program account to 529 College Savings Plan When combined, your cashback will be increased to 1.529%.

- Upromise Round Up: Upromise Round Up lets you round up your purchases to the next whole dollar amount, based on the threshold you set (from $1 to $500). The total Round Up Amount is considered a purchase and earns 1.25% cash back or 1.529% if linked to an eligible College Savings Plan. The rules are too complicated, so I won’t translate them for now. Let’s ignore the threshold and give an example to explain what it means. For example: for a purchase of $0.01, the round up amount is $0.99, and you are charged a total of $1.00. This $0.99 itself will be converted into cashback and returned to you. Then the cashback amount that should be earned for the consumption amount of $1.00 is $1.00*1.529% = $0.01529 (assuming there is a bonus), so the total cashback is $0.99 + $0.01529 = $1.00529. This rule is super complicated, but the extra cashback earned is only a few tenths of a cent, which is completely useless and not worth the effort.

- No Foreign Transaction Fee (FTF).

- No annual fee.

shortcoming

- The cashback ratio is low and the rules are too complicated.

Recommended application time

- Barclays places great emphasis on recent Hard Pulls and recommends applying when the number of Hard Pulls within 6 months is less than 6, although this is not a strict rule.

- [6/24 rule] Similar to Chase’s 5/24 rule, Barclays will also reject you if you have 6 or more new accounts within 24 months. However, unlike Chase, Barclays’ rule is not strictly enforced and there are often counter-examples.

- It is recommended that you apply after having a credit history of more than one year.

- Theoretically, only Permanent Residents (green card holders or citizens) can apply for Barclays credit cards. The screenshot below is from the application details. In fact, the bank does not really verify whether you are a green card holder or citizen. Non-green card holders can also apply, but at their own risk.

Summarize

This card is a scam for kids. The rules are so complicated that people can hardly understand them. You can operate it like a tiger, but you can't make a few cents more. Although there is a sign-up bonus, it is still a rubbish card. . .

After applying

- Barclays can check the status of your application Click here.

- Barclays reconsideration backdoor number: 866-408-4064. Barclays will like to ask you various questions in detail, so you must be confident about your personal situation and credit report. In addition, their reconsideration is likely to hard pull again, but they will also inform you in advance, so you can use your own discretion.

Sign-up bonus trend chart

Application Link

END