The Hilton Honors American Express Aspire Card Hilton Hotel Credit Card Overview

[Updated September 2024] Previously, the hotels that can be used for resort credit on this card were all hotels marked as resorts on the Hilton official website (about 320 hotels), but now Hillton has redefined the list of hotels that can be used for resort credit:

There are 256 hotels on this list. Obviously, not all resort hotels are on it. There are about 20% less than before. For example, Conrad Las Vegas is on the resort list, but it is no longer on this reimbursement available page. If you want to use the Aspire card's resort credit in the future, you must find the hotel from the above page. Correspondingly, we have also updated the Hilton resort list on HotelFT to make it easier for everyone to use the map mode to query the available hotel list:

H/T: DoC And discovered this earlier Forum user Island

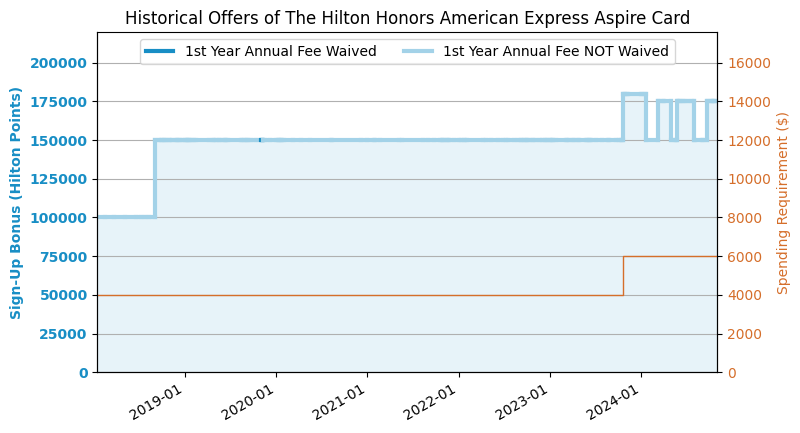

[2024.9 Update] 175k sign-up bonus is back. Ends on 2025/01/08.

Application Link

feature

- 175k sign-up bonus: Earn 175,000 Hilton Honors Points after spending $$6,000 or more within 6 months from account opening.The highest sign-up bonus recently is 180k.

- Hilton Honors Points are worth about 0.4 cents/point (Hotel Points Valuation). Points required to redeem hotels of different levels:Hilton Rewards Redemption ChartTherefore, its highest sign-up bonus of 180k is worth about $720!

- You can earn 14x points when staying at Hilton hotels, 7x points on dining, car rentals, and air tickets, and 3x points on other purchases.

- Every year (card membership year)(From the moment you open the card!)Get one Free Night (FN) with no tier restrictions. Get one more FN for every $30k spent and one more FN for every $60k spent per calendar year.

- Free gift for holders of this card Hilton Diamond member.

- 【New】$200 Airline Reimbursement: $50 per quarter, totaling $200 per year. Note that this airline reimbursement is different from the airline reimbursement of other AmEx cards. You can also report the flight ticket itself, and there is no need to specify a specific airline.AmEx Hilton Aspire new version $200 air reimbursement, which ones can be triggered?》.

- 【New】$400 Hilton Resorts Credit: Hilton ResortCheck in and use this card to make purchases, and you can get reimbursement.Room charges can also be reimbursed!$200 every six months, which adds up to $400 a year.

- 【New】You can get $189 CLEAR membership fee reimbursement every calendar year. CLEAR is a service that helps you pass the ID check at the airport quickly. This article.

- Book the Aspire Card Package at Waldorf Astoria or Conrad and enjoy $100 on-property credit.But it is better to choose Hilton Impresario project than to book this package. For details, see《Hilton Impresario Introduction》.

Cardholders will receive a separate Priority Pass Select (PPS) The card can be used in many lounges around the world (including China), such as the first-class lounges of Air China and other airlines in Beijing. The PPS card given with this card can bring up to 2 companions for free, and additional people are charged at $27/person. Please note that the PPS card given with the AmEx card can only enter the airport lounges that cooperate with PPS for free, but not the restaurants that cooperate with PPS. Click hereenroll.[Update: This benefit is no longer available for applications after 2023/10/19. If you need a PPS card, you can get another high-end card. ]- 【New】$800 mobile phone insurance: Maximum of $800 per claim, maximum of 2 claims per year, deductible $50. Coverage includes theft and damage. Just use this card to pay for your mobile phone bill.

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can earn 20k Hilton points for each successful application, up to a maximum of 80k/calendar year.

- No Foreign Transaction Fee (FTF).

shortcoming

- 【New】Annual fee $550, first year annual fee not waived. (Annual fee before 2023/10/19 is $450.)

Recommended application time

- Please note that AmEx’s sign-up bonus policy is: if you have or have had a card before, you will not be able to get this card’s sign-up bonus. So if you want to squeeze out the value and get both the sign-up bonus and the upgrade bonus, you must first open a card and get the sign-up bonus, then go for the upgrade/downgrade.

- You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

- A maximum of 2 credit cards can be approved within 90 days. Charge cards are not subject to this rule. Cards approved on the same day will have their Hard Pulls combined.

- You can hold up to 5 AmEx credit cards at the same time, but charge cards are not subject to this rule.

Summarize

One of the highlights of this card is the Diamond membership. Compared to working hard to get the highest level, you can get the highest level by just holding the card. This is really a big blow to many frequent travelers. Although the annual fee of $550 is very expensive, after deducting $200 in airline credits and $400 in resort credits (both of which are very easy to get), you can also get a free FN every year! If you are willing to stay at Hilton more often, it is definitely worth holding for a long time! Although the sign-up bonus is only 180k Hilton points, which seems not much, don’t forget that the annual FN is given from the time you open the card, so you don’t have to wait until the second year to get it. In fact, this can also be considered as part of the sign-up bonus.

Let me say one more thing about Hilton resort credit: Even if you book a fully refundable room and pay a deposit, it can trigger reimbursement!

Related credit cards

- AmEx Hilton

- AmEx Hilton Surpass

- AmEx Hilton Aspire (this article)

- AmEx Hilton Business

Best downgrade option

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart