Blue Cash Preferred Card from American Express (BCP) Credit Card Overview

[Updated 2024.9] The sign-up bonus has been reduced to $250.

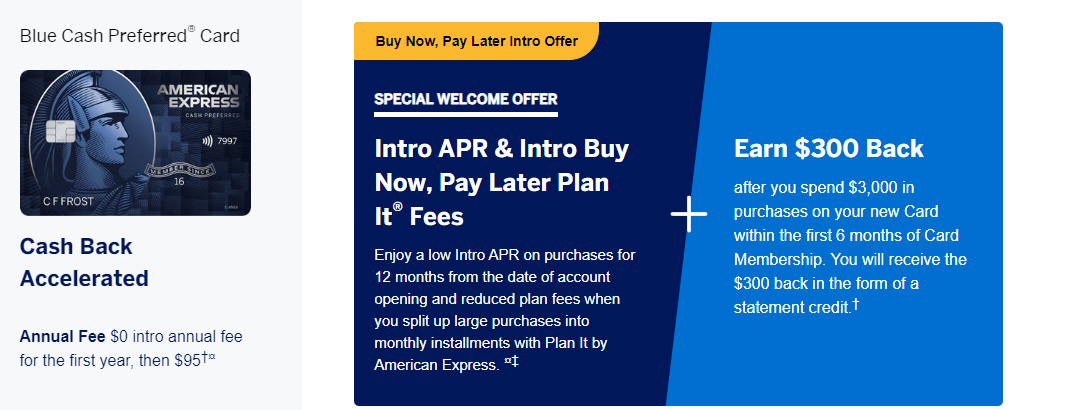

[2024.6 Update] The new sign-up bonus is $300, which needs to be redeemed in stealth mode.

[Updated in 2023.3] The latest sign-up bonus is $300 for spending $3000 in 6 months, and $100 for spending in the first 3 months (it seems that the $100 spending before opening the card is fully refunded, which is almost equivalent to $100 refund for spending), totaling $400, and the annual fee is waived in the first year. This is the best sign-up bonus in the history of this card! Only some targeted people can generate this bonus in the form of referral link.

Application Link

feature

- $250 sign-up bonus: earn $250 after spending $3,000 in 6 months.The highest sign-up bonus recently is $400.

- 6% cashback on supermarkets, 6% cashback on select US streaming subscriptions (see definition) here), refueling and transportation 3% Cashback (transportation includes taxis/rideshare, parking, tolls, trains, buses, etc.), other categories 1%.

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can get $100 for each successful application, up to a maximum of $550 per calendar year.

shortcoming

- Annual fee is $95, waived for the first year.

- The annual (Calendar Year) supermarket 6% cashback limit is $6,000, and after that it is only 1%.

- according to Definition of American Express, Walmart, Target, and Costco are not considered supermarkets, so you can only get 1%.

- This card is an American Express card, not a Visa or MasterCard, so some small Chinese supermarkets may not accept it.

- The 6% and 3% types are only valid in the U.S. But since this card has a Foreign Transaction Fee anyway, just don’t use it outside the U.S.

Recommended application time

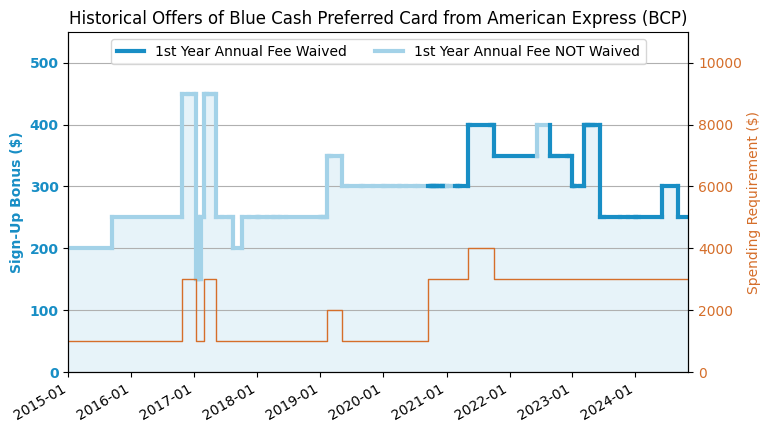

- You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- 【New】【Same series restrictions】AmEx has begun to gradually limit the sign-up bonuses of the same series of cards: high annual fee cards will affect low annual fee cards. Specifically, if you have opened a BCP with a high annual fee, it will affect the sign-up bonus of the BCE with a low annual fee, so if you want to get both, it is recommended to open a BCE first.

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

- The application interval for BCE/BCP cannot be less than 90 days, otherwise the application will be cancelled.

- A maximum of 2 credit cards can be approved within 90 days. Charge cards are not subject to this rule. Cards approved on the same day will have their Hard Pulls combined.

- You can hold up to 5 AmEx credit cards at the same time, but charge cards are not subject to this rule.

Summarize

This is a good grocery card. You can do some simple math. Although there is an annual fee of $95, as long as the supermarket consumption exceeds $300 per month (assuming you hold Freedom), you can get supermarket discounts that exceed any card without an annual fee. Therefore, for the majority of poor students who cook their own meals, although there is an annual fee, this may also be a must-have card suitable for long-term holding! If you have a preference for MR points and can swipe 30 times a month, another good grocery card that you can hold for a long time is AmEx EveryDay Preferred (EDP)For details, seeComparison of common grocery/supermarket credit cards》.

There is another advanced use of this card: find the gift cards of the stores you often go to (such as Shell, Amazon, etc.) or general gift cards such as Visa Gift Cards in the supermarket, and use Blue Cash Preferred to buy them, and you will get 6% cash back (there is a limit of $6000 per year, and if it exceeds, there will only be 1% cashback), and then use them to buy other things. Gift cards from other stores are purchased at the same value; while the purchase fee of Visa Gift Card is the face value + a fixed amount of $5.95, so it is best to buy the Visa Gift Card with the largest face value, which is $500. In this way, if you use it to buy other things, it is equivalent to about Everything 5~6% cashback! So the monthly supermarket consumption mentioned in the summary should also include these consumption.

Related credit cards

- AmEx EveryDay (ED)

- AmEx EveryDay Preferred (EDP)

- AmEx Blue Cash Everyday (BCE)

- AmEx Blue Cash Preferred (BCP) (this article)

- AmEx Old Blue Cash (OBC)

Best downgrade option

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart

Note: There are some sign-up bonuses like $250 + $200. The latter part of $200 is actually 10% cashback up to $200 for spending in a certain category in the first six months. These past offers of $450 bonuses did not have an annual fee waiver for the first year, so they are actually not as good as the current $400 + first year annual fee waiver.