Blue Cash Everyday Card from American Express (BCE) Credit Card Overview

[2023.1 Update] The $150 PayPal+$100 offer has expired. The current sign-up bonus is $200 offer or $200+$150 via Resy.

[Updated in 2022.10] The new sign-up bonus is $150 Paypal + $100: Get 20% cash back up to $150 cash back (i.e. $750 PayPal spending) on PayPal within 6 months of card opening. In addition, you can get another $100 after spending $2,000 within 6 months of card opening.

[2022.7 Update 2] In addition to the $250 sign-up bonus on the AmEx official website, there is now Another $200+$150 sign-up bonus is available via Resy: Get $200 for every $2,000 you spend within 6 months after opening the card, and get 10% cashback up to $150 cashback on dining. As long as you eat out a lot, this sign-up bonus is slightly better.

Application Link

feature

- $200+$150 Sign-up Bonus: Get $200 after spending $2,000 within 6 months of account opening. Get 10% cash back on dining within 6 months, up to $150 cash back.

- 3% cash back for supermarkets, gas stations, and online shopping (US Online Retail Purchases), and 1% cash back for other consumption.

- The specific definition of the online shopping (US Online Retail Purchases) category is: "The purchase must be made on a website or a digital application (an app) from a US retail merchant that sells physical goods or merchandise directly to consumers." It takes data points to confirm which one counts and which one does not among the many websites. Therefore, if you want to make a large purchase, it is best to try a small amount first to see if there is 3%.

- It is very easy to apply, and you can apply once you have a credit history for 3 months (please make sure you can check your credit history first).

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can get $75 for each successful application, up to a maximum of $550 / calendar year.

- No annual fee.

shortcoming

- The spending limit for the 3% cashback categories each year (Calendar Year) is $6,000 each, and after that it is only 1%.

- according to Definition of American Express, Walmart, Target, and Costco are not considered supermarkets, so you can only get 1%.

- This card is an American Express card, not a Visa or MasterCard, so some small Chinese supermarkets may not accept it.

- 3% cashback category is limited to the United States. But this card has a Foreign Transaction Fee anyway, so just don’t use it outside the United States.

Recommended application time

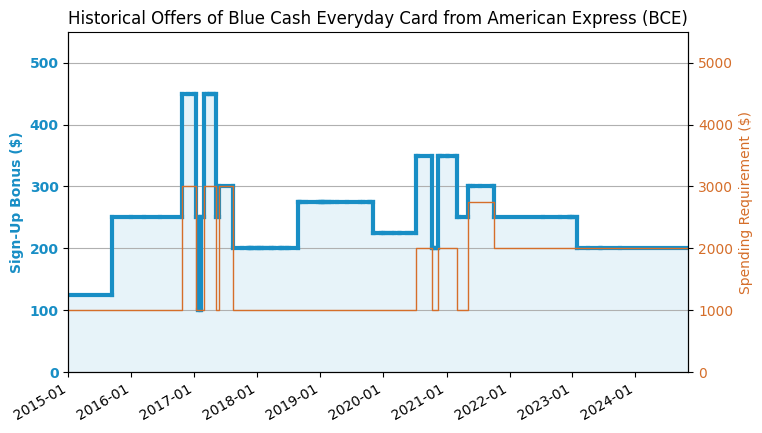

- You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- 【New】【Same series restrictions】AmEx has begun to gradually limit the sign-up bonuses of the same series of cards: high annual fee cards will affect low annual fee cards. Specifically, if you have opened a BCP with a high annual fee, it will affect the sign-up bonus of the BCE with a low annual fee, so if you want to get both, it is recommended to open a BCE first.

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can try to apply if you have a credit history of more than three months.

- The application interval for BCE/BCP cannot be less than 90 days, otherwise the application will be cancelled.

- A maximum of 2 credit cards can be approved within 90 days. Charge cards are not subject to this rule. Cards approved on the same day will have their Hard Pulls combined.

- You can hold up to 5 AmEx credit cards at the same time, but charge cards are not subject to this rule.

Summarize

After the revision, the 3% categories became supermarkets, refueling and online shopping, which are quite practical.

There are some other options for grocery cards, see "Comparison of common grocery/supermarket credit cards》.

Related credit cards

- AmEx EveryDay (ED)

- AmEx EveryDay Preferred (EDP)

- AmEx Blue Cash Everyday (BCE) (this article)

- AmEx Blue Cash Preferred (BCP)

- AmEx Old Blue Cash (OBC)

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart

Note 1: There are some sign-up bonuses like $250 + $200. The latter part of $200 is actually the cashback of 10% up to $200 for spending in a certain category in the first six months.

Note 2: The sign-up bonus of $300 is actually: spend $500 per month in the first 6 months and get $50, which means you spend $3,000 and get $300. It's quite complicated.