American Express Platinum Card for Schwab

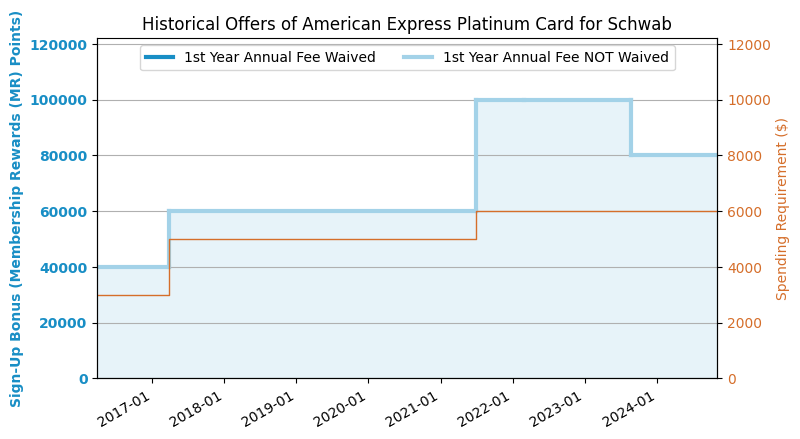

[2023.8 Update] The sign-up bonus has been reduced from 100k to 80k.

[Updated 2022.3] The sign-up bonus of extra +10x on dining and shop small has expired. The current sign-up bonus is 100k.

[Updated in September 2021] The rate at which Schwab Platinum redeems MR points has been reduced from 1.25 cpp to 1.1 cpp starting from September 1, 2021.

Application Link

- AmEx Platinum for SchwabBefore you apply for this card, you must first have Charles Schwab Brokerage Account.

feature

- 80k sign-up bonus: Earn 80,000 Membership Rewards (MR) points after spending $6,000 or more within 6 months after account opening.The highest sign-up bonus recently is 100k+10x dining+shop small.

- The points earned from this card are Membership Rewards (MR), and we estimate it to be 1.6 cents/point. See below for a brief introduction. Therefore, the 100k sign-up bonus is worth about $1,600!

- [Schwab version exclusive benefits] With this card, you can exchange MR points for cash at a fixed value of 1.1 cents/point and deposit it into your Schwab Brokerage Account! This is the only card that can exchange MR points for cash at a high value. This way, you will not receive a tax return when you redeem MR points.The specific steps for exchanging money for Schwab Platinum are here.(Before September 2021, the redemption rate was 1.25 cents/point.)

- [Schwab version exclusive benefits] Schwab Appreciation Bonus: If you have more than $250k assets in your Schwab investment account, you will receive $100 per year; if you have more than $1M assets, you will receive $200 per year. This asset requirement is relatively high, and is basically only suitable for friends who already have a lot of assets that have to be placed in a certain brokerage firm, not for those who specialize in it.

- You can earn 5x MR points (up to $500k) when booking air tickets on the official airline website, 5x MR points when booking air tickets and prepaid hotels on AmEx travel, and 1x MR points on other purchases.

- This card has various reimbursement benefits, see the next section for details.

- Cardholders can enter the following Airport Lounges for free:

- Priority Pass Select (PPS),need Enroll yourself, a Priority Pass Select (PPS) card will be sent to the primary and secondary cardholders separately, which allows two people to travel with you for free. Please note that the PPS card given by AmEx card can only enter PPS-partnered airport lounges for free, but not PPS-partnered restaurants.

- Centurion Lounges, cardholders can enter for free, and companions need to pay $50; if the cardholder spends more than $75k on the platinum card each year, he or she can bring 2 people for free.

- The International American Express Lounges, the companion policy varies by airport, and you can bring at least 1 person for free;

- Escape Lounges, you can bring 2 companions in for free;

- Delta Sky Clubs, you need to take the Delta flight of the same day, and the companions are $29 each. [Updated in September 2023] From February 1, 2025, holders of this card will be able to enter Skyclub 6 times in each Medallion year (February 1 to January 31); if you spend $75,000 on this card in a calendar year (1.1-12.31), you will be able to enter Skyclub unlimited times in that Medallion year and the next Medallion year.

- Plaza Premium Lounges, you can bring 2 companions in for free;

- Air Space Lounges, you can bring 2 companions in for free.

- pass Fine Hotels & Resorts (FHR) If you book a high-end hotel, you can enjoy the hotel's elite member benefits, such as upgraded room types, free Wi-Fi, free breakfast, etc., depending on the specific hotel. For a detailed introduction to FHR, see This article.

- Giveaway Marriott Bonvoy Gold Members, need to click This link to activate.

- Giveaway Hilton Gold Members, need to click This link to activate.

- To get free membership of Avis, Hertz, and National, click This link to activate.

- Platinum Card Concierge Service: For lazy or busy people, you can use this service to book restaurants, etc. The service is said to be very powerful.

- $800 mobile phone insurance: each claim limit is $800, 2 claims per year, deductible is $50. The insurance covers theft and damage. Just use this card to pay for your mobile phone bill.

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can earn 15k MR points for each successful application, up to a cap of 55k / calendar year.

- The application is easy because strictly speaking it is a charge card rather than a credit card. Charge card means that you cannot just pay the minimum payment, but must pay off the full balance before each due date. Please note that there will also be a hard pull when applying for a charge card, just like a credit card.

- Charge Cards have no pre-set spending limit.

- No Foreign Transaction Fee (FTF).

Various reimbursement benefits

Platinum cards have many reimbursement benefits. This section specifically lists the reimbursements and recommended ways to use them:

- 【$200 Airline Miscellaneous Fees Reimbursement】$200 of airline miscellaneous fees (such as baggage fees, airport lounge tickets, etc., excluding the air tickets themselves) can be reimbursed every calendar year. Because this benefit is calculated based on the calendar year rather than the length of card holding, you can actually be reimbursed twice before the second year's annual fee is collected! Please note that this benefit is not automatically effective and requires Enroll yourself and specify the airlineAviation miscellaneous expenses reimbursement is difficult to use according to formal terms, but there are ways to squeeze its value. For detailed methods, see "[Tips and Tricks] Tips on how to claim airfare on AmEx》.

- [$200 FHR/THC hotel reimbursement] You can reimburse $200 for hotel expenses at Fine Hotels & Resorts (FHR) or The Hotel Collection (THC) every calendar year. It must be a prepaid rate. Duration requirement: one night for FHR, at least 2 nights for THC. Because this benefit is calculated based on the Calendar Year rather than the length of time you hold the card, you can actually reimburse twice before the annual fee for the second year is collected! Most hotels in FHR are relatively expensive. For details on the cheaper hotels in the United States that are suitable for this reimbursement, please see "Amex Platinum Card FHR $200 Reimbursement Recommendation: US Hotel List》.

- 【$200 Uber Credit】Get $15 uber credit every month, $35 in December, that’s $200 in total per year. Unused credit will expire automatically.

- [$100 Saks Reimbursement] Get $50 every January to June, and another $50 every July to December. This can be triggered on Saks' website and in-store. enrollIf you don't know what to buy, you can refer to"What should I buy with my American Express Platinum Card Saks reimbursement?".

- 【free Walmart+ Members: If you pay for Walmart+ membership with Amex Platinum every month, you can get full membership reimbursement ($12.95/month). The main benefits of Walmart+ membership are free shipping and free grocery delivery.

- 【Global Entry / TSA Pre-check reimbursement】This card can be reimbursed Global Entry ($100) or TSA Pre✓ ($85), up to $100. Global Entry is the fast track of US Customs, TSA Pre✓ is the fast security lane at US domestic airports. Only US citizens or green card holders can apply for them.

- 【$179 Clear Reimbursement】 Clear is a fast ID check service at airports, see This articleThe annual fee is exactly $179, and this reimbursement can offset it. Friends who fly frequently can use it, but it is not worth much.

- [$240 Digital Entertainment Reimbursement] $20 per month, can only be used in Hulu, Disney+ and other places, see the introduction This article. The value is basically 0.

- 【$300 Equinox Reimbursement] $300 per year, only for Equinox membership fee. The value is basically 0.

shortcoming

- Annual fee is $695. The first year annual fee is not waived.[Friendly reminder] The annual fees of all credit cards are not included in the card opening consumption task!

Supplementary Card

There are two types of Platinum Card supplementary cards: Platinum Supplementary Card andSilver Card. The reimbursement limits for various primary and secondary cards are the same, and there is no separate limit.

- Platinum additional card holders need to pay, and the annual fee for each card is $195. The main benefits of platinum additional card holders include: they can have a separate PPS card and free access to the aforementioned Airport Lounges, they can obtain hotel premium membership separately, and they can book hotels through FHR, etc.

- There is no annual fee for a silver card supplementary card, but there are no benefits. In terms of spending and accumulating points, swiping the supplementary card is equivalent to swiping the primary card.

Introduction to MR Points

- The main credit cards that can earn MR points are:AmEx ED, AmEx EDP, AmEx Green, AmEx Gold, AmEx Platinum, AmEx Platinum for Schwab, AmEx Platinum for Morgan Stanley, AmEx Blue Business Plus, AmEx Business Green, AmEx Business Gold, AmEx Business Platinum etc.

- The MR points accumulated from each MR card are automatically accumulated to the same MR account.

- MR points never expire. Closing a card will not cause the MR points accumulated on that card to disappear, but if you close all MR cards, all MR points will disappear. In order to avoid the loss of MR points, it is recommended that you hold a no-annual-fee card for a long time. AmEx ED.

- If you hold any MR card, you can convert MR into some airline miles. The most common and cost-effective way to use MR is to convert 1:1 into All Nippon Airways (ANA, NH) Miles (Star Alliance). Other recommended miles include: Air Canada(AC)(Star Alliance),Delta Air Lines(DL)(Trina),British Airways(BA)(Universe),Cathay Pacific Asia Miles(Universe),Singapore Airlines(SQ)(Star Alliance),Air France-KLM Flying Blue(Trina),Virgin Atlantic (VS)(Non-alliance) etc. If used this way, the points are worth about 1.6 cents/point.

- Holders of any MR card can directly redeem points at a fixed value of about 1 cent/point on AmEx travel portal Book your flight online.

- In holding AmEx Platinum for Schwab If you have the MR points card, you can redeem them at a fixed rate of 1.1 cents/point. If you don’t like to study miles, this is a good option. If you don’t have this card, you can only redeem MR points at a fixed rate of 0.6 cents/point.

- In summary, we estimate the value of MR points to be approximately 1.6 cents/point.

- For more information on the MR Points system, seeMaximize the value of your credit card points” (review) andHow to earn MR points》《MR Points Usage》(Super detailed).

Recommended application time

- [Limited to once in a lifetime for the same card] You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- 【New】【Restrictions on different versions of Platinum Card】The different versions of the Platinum Card will affect each other’s sign-up bonus, so you can only get one of them.

- 【New】【Same series restrictions】AmEx has begun to gradually limit the sign-up bonuses of the same series of cards: the high annual fee will affect the low annual fee. Specifically, if you have opened a Platinum card with a high annual fee, it will affect the sign-up bonus of the Gold card with a low annual fee, so if you want to get both, it is recommended to open a Gold card first.

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

- The application interval between different versions of Platinum Cards cannot be less than 90 days, otherwise the application will be cancelled.

Summarize

This card is very special for the MR points system! With this card, MR points can be exchanged for cash at a ratio of 1:1.1! For those who don’t want to spend time studying miles, this exchange ratio is actually worth considering.

The 100k sign-up bonus is pretty generous.

This card can earn 5x MR points when purchasing air tickets, which is the credit card with the highest return rate for buying air tickets. At the same time, because this card has a 6-hour trigger Delay Insurance , so it can be regarded as the best credit card for buying air tickets. This card also has many other travel benefits, such as more airport lounge benefits than other high-end cards, partner lounges, FHR, etc. For a comparison of this card and other high-end cards, see " High-end credit cards comparison》.

After the 2017 revision, the annual fee of this card has increased to $695, and there are many more reimbursement benefits. It has been nicknamed the "coupon book card". These reimbursement benefits can offset part of the annual fee: $200 airline miscellaneous expenses reimbursement can be squeezed out with tricks, and it is about $140 if calculated at the face value of 70%; $200 FHR hotel reimbursement can also be slightly utilized if you find a hotel with a suitable price, and it is about $140 if calculated at the face value of 70%; $200 Uber credit expires every month and is a bit useless, and it is also worth $140 if calculated at the face value of 70%; $100 Saks credit may not be your rigid need, and its value is about $70 if calculated at the face value of 70%. The other reimbursements are basically worthless. If you can use them, use them. If you can’t use them, forget it. With such a high annual fee, if you are not the kind of person who travels frequently and can use the travel benefits, the annual fee of this card is difficult to recover, so it is not suitable for long-term holding.

If you do not want to keep this card for a long time and have not used up all your MR points before closing the card, you can apply for a no annual fee card. AmEx Everyday (ED) To preserve MR points for future redemption when needed.

To Do List after getting the Platinum Card

Platinum cards have many benefits, some of which need to be enrolled manually, so here is a to-do list after getting a new card to avoid missing out on benefits:

- Enroll Aviation expenses reimbursement Benefits and specify airlines. You must enroll for this benefit and specify an airline in advance to receive air reimbursement.

- Add your Platinum card to the Uber or UberEats app.

- Enroll Saks Credit Welfare.

- Enroll Priority Pass Select (PPS) Airport lounge benefits.

- Enroll Marriott Bonvoy Gold Tier.

- Enroll Hilton Gold Level.

- Enroll Avis, Hertz and National Car rental membership level benefits.

- Enroll Walmart+ Membership.

- Apply Global Entry ($100 reimbursement) or TSA PreCheck ($85 reimbursement). Please note that only US citizens or green card holders can use this benefit.

Related credit cards

- AmEx Platinum Standard Edition

- AmEx Platinum for Schwab (this article)

- AmEx Platinum for Morgan Stanley

See the comparison of benefits of each version This article.

Best downgrade option

- This card cannot be downgraded to any other card, so it is recommended to directly level it up if you don't want to keep it.

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart

Application Link

- AmEx Platinum for SchwabBefore you apply for this card, you must first have Charles Schwab Brokerage Account.