Schwab Investor Card from American Express Credit Card Overview

[Updated 2021.6] The $200 sign-up bonus is back. This card has a very low daily cash back rate, is not worth much, and occupies an AmEx card slot (AmEx card slots have been reduced from 5 to 4 since the pandemic began), so I don’t recommend applying for it. If you want to apply for this card despite all the dissuasion, now is a good time.

[Updated 2020.11] The $200 reward has expired, and only the $100 regular reward is left. Please wait patiently for the next one.

[Updated in September 2020] The $200 sign-up bonus is back, and expires on November 4, 2020. This card has a very low daily cash back rate, has little value, and occupies an AmEx card slot (AmEx card slots have been reduced from 5 to 4 since the pandemic began), so it is not recommended to apply for it. If you want to apply for this card despite the dissuasion, now is a good time.

Application Link

- AmEx Schwab InvestorBefore you apply for this card, you must first have Charles Schwab Brokerage Account.

feature

- $200 Sign-up Bonus: Earn $200 after spending $1,000 or more within 3 months after opening the card.

- 1.5% cash back on all purchases.

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- No annual fee.

shortcoming

- Foreign Transaction Fee (FTF) does exist, so don’t use it outside the United States.

Recommended application time

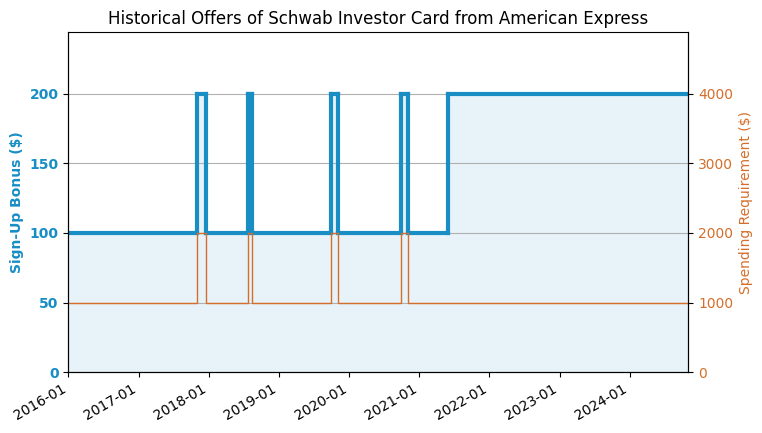

- You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

AmEx can only approve 1 credit card at most in 1 day. Charge Cards are not subject to this restriction. It is fine to apply for one credit card and multiple charge cards on the same day.Cards approved on the same day will have the Hard Pull combined.- A maximum of 2 credit cards can be approved within 90 days. Charge Cards are not subject to this rule..

- You can hold up to 5 AmEx credit cards at the same time, but charge cards are not subject to this rule.

Summarize

1. There are many cards that offer 5% cashback now. If you focus on daily cashback, I recommend the card that offers 2% cashback on all purchases with no annual fee. Citi Double Cash (DC). Note that the official FAQ of this card states: This Card is issued by American Express Bank, FSB. In other words, this card is not a third-party AmEx card issued by Schwab, but an AmEx card! So it takes up a card slot (AmEx credit cards can hold up to 5 cards at the same time)!AmEx only has 5 card slots, it is better not to waste it on such a low-quality card.

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart

Application Link

- AmEx Schwab InvestorBefore you apply for this card, you must first have Charles Schwab Brokerage Account.