Bank of America Premium Rewards Elite Credit Card Overview

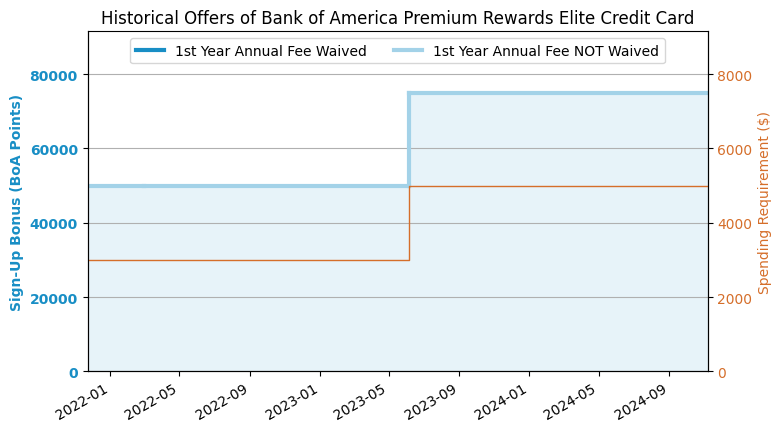

[2023.6 Update] The new sign-up bonus is 75k, a record high.

Application Link

feature

- 75k sign-up bonus: Earn 75,000 points after spending $5,000 or more within 90 days of account opening.This is the highest sign-up bonus for this card.

- Points can be directly exchanged for statement credit at a 1:1 ratio, or deposited into a BoA savings account, etc. Redeem air tickets on the BoA website or through customer service to enjoy 20% off, which is equivalent to 1.25 cents/point. Therefore, the maximum value of the 75k sign-up bonus is $937.5.

- Earn 2x points on travel and dining, and 1.5x points on all other purchases.

- BoA Preferred Rewards Account Tiers Bonus: If you have BoA checking account , and in a BoA bank account + Merrill Edge Investment Account If the asset size reaches a certain level, you can get a cashback bonus. Gold level (need assets over $20k) can get 25% more; Platinum level (need assets over $50k) can get 50% more; Platinum Honors level (need assets over $100k) can get 75% more.

- per calendar year $300 Reimbursement of airline miscellaneous expenses: seat selection, baggage, lounge fees, etc., automatically returned to the account. Note that this cannot be used to directly reimburse air tickets.

- per calendar year $150 reimbursement is available for the following categories: rideshare, food delivery, streaming service and fitness transactions.

- Cardholders also receive free Priority Pass Select (PPS) Card, you can bring 2 people for free. PPS card members can use more than 1,300 airport lounges around the world, such as Air China's Beijing First Class Lounge. Supplementary cardholders can also have their own separate PPS card. Many cards offer free PPS that no longer include restaurants This full-blood PPS still makes sense.

- $100 TSA Pre or Global Entry reimbursement (every four years).

- No Foreign Transaction Fee (FTF).

shortcoming

- $550 annual fee, not waived in the first year. [Friendly reminder] All annual fees are not included in the card opening consumption requirements!

Recommended application time

- It is recommended that you apply after having a credit history of more than one year.

- 【2/3/4 Rule】A maximum of 2 BoA cards can be approved within 2 months; a maximum of 3 BoA cards can be approved within 12 months; a maximum of 4 BoA cards can be approved within 24 months. Currently, BoA’s IT system is still quite poor, so this rule may not reject you at the beginning, but it is possible that your application is approved at first, and then a few days later, you find that the card is closed because it is “approved in error”.

- If you currently hold this card or have held it within the past 24 months, you will not be able to apply for this card.BoA 24 Month Churn Card Rules.

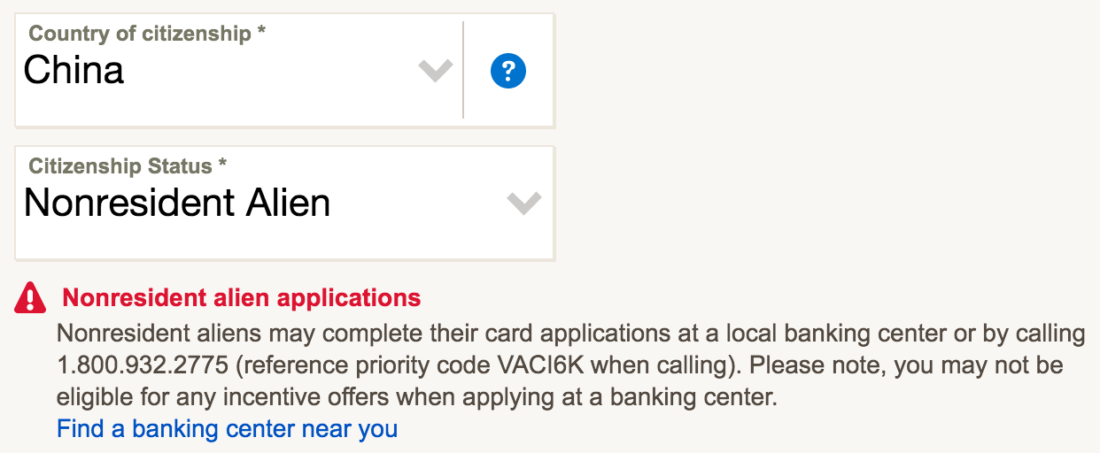

- Theoretically, BoA’s credit card is only valid for US persons (seeIdentification of tax filing status》) can apply online. If you are a Non-Resident Alien (NRA), you need to call or go to the local branch to apply. In fact, the bank will not really verify whether you are a US Person. NRA online applications can also be approved, but at your own risk.

Summarize

This card is BoA Premium Rewards A slightly enhanced version of the BoA, with the same rebate structure. The annual fee for this card is $550. If you can easily use up $300+$150 for reimbursement, there will still be $100 of annual fee that you have nowhere to put. Just think of it as buying a PPS membership. This card has one use in BoA's point system, which is to redeem points. If you use it to buy air tickets through BoA's own travel portal, you can redeem points at a fixed value of 1.25 cpp. If you have accumulated a lot of BoA points, then it is still worth redeeming through this card. Add BoA Preferred Rewards (assuming the highest level) and calculate the 25% value-added for redeeming airlines, then this card will return at least 1.5%*1.75*1.25=3.28% for every $1 spent. It's barely acceptable, but there are still many restrictions. I don't know if BoA's own travel portal is easy to use. Overall, this card is average. The annual fee is not competitive enough. It is basically only suitable for people who have accumulated a lot of BoA points and then abandon it after one year.

Related credit cards

- BoA Customized Cash

- BoA Unlimited Cash

- BoA Travel Rewards

- BoA Premium Rewards

- BoA Premium Rewards Elite (this article)

Best downgrade option

After applying

- BoA application status query can Click here.

- BoA reconsideration backdoor number: 877-383-0120 or 866-811-4108. It seems that BoA's phone number keeps changing... If the number is disconnected, please let us know immediately. BoA can directly contact the person who has the decision-making power.

Sign-up bonus trend chart