Hawaiian Airlines® World Elite Mastercard® Credit Card Overview

【2024.10 Update】VFTW I recently interviewed the VP of Alaska Airlines and learned that after HA and AS are fully merged (around the end of 2025), there will be only one co-branded credit card issuer (BoA), and this HA co-branded card will be discontinued and converted to an AS co-branded card. So if you are interested in getting a lot of AS miles, you still have about a year to consider whether to buy this card.

【2024.9 Update】In view ofHA and AS are about to merge. If the merger is successful, the HA mileage will be converted to AS mileage at a 1:1 ratio., the sign-up bonus of this card suddenly became more attractive, so I gave it a thumbs up. [Update] Added a link to the Bank of Hawaii version, which only requires 1 transaction to get the sign-up bonus. My understanding is that the Bank of Hawaii version is just a cover, and Barclays is still responsible for the approval and daily use of the card.

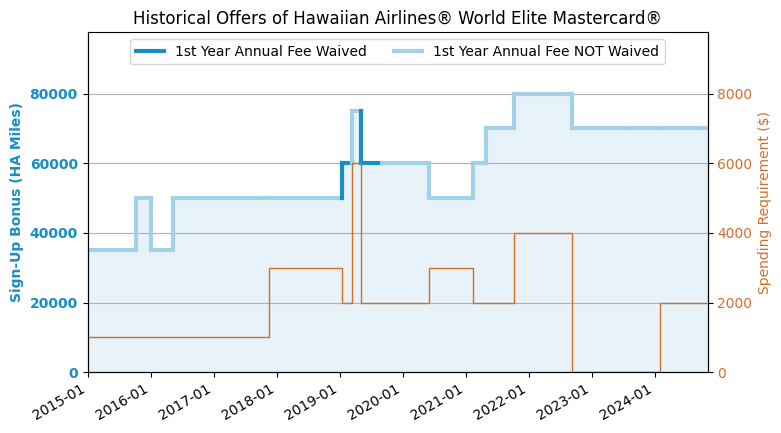

[2024.2 Update] The 70k sign-up bonus has been changed and the link is still available.

Application Link

feature

- 70k sign-up bonus: Earn 70,000 Hawaiian Airlines miles after spending $2,000 within 90 days of account opening.The highest sign-up bonus recently is 80k.

- After you activate the card, you will receive a round-trip ticket from North America to Hawaii for the second person at half the price.

- Hawaiian Airlines offers 1 free checked bag.

- Hawaiian Airlines purchases earn 3x miles, meals, supermarkets and gas earn 2x miles, and other purchases earn 1x miles.

- Cardholders can receive points transferred from family and friends on the Hawaiian Airlines official website.

- After paying the annual fee every year, you will receive a $100 coupon for your friend ticket. After spending $10,000 per year, you will get an additional 5,000 points.

- No Foreign Transaction Fee (FTF).

shortcoming

- The annual fee is $99, and the first year's annual fee is not waived.

- If you are unable to apply for the World Elite version of the Hawaiian Airlines card, Barclaycard may issue you a downgraded version with reduced benefits.

- Hawaiian Airlines does not belong to the three major airline alliances and does not have any good redemption partners. It is basically only suitable for redeeming flights to Hawaii.

HA Mileage Overview

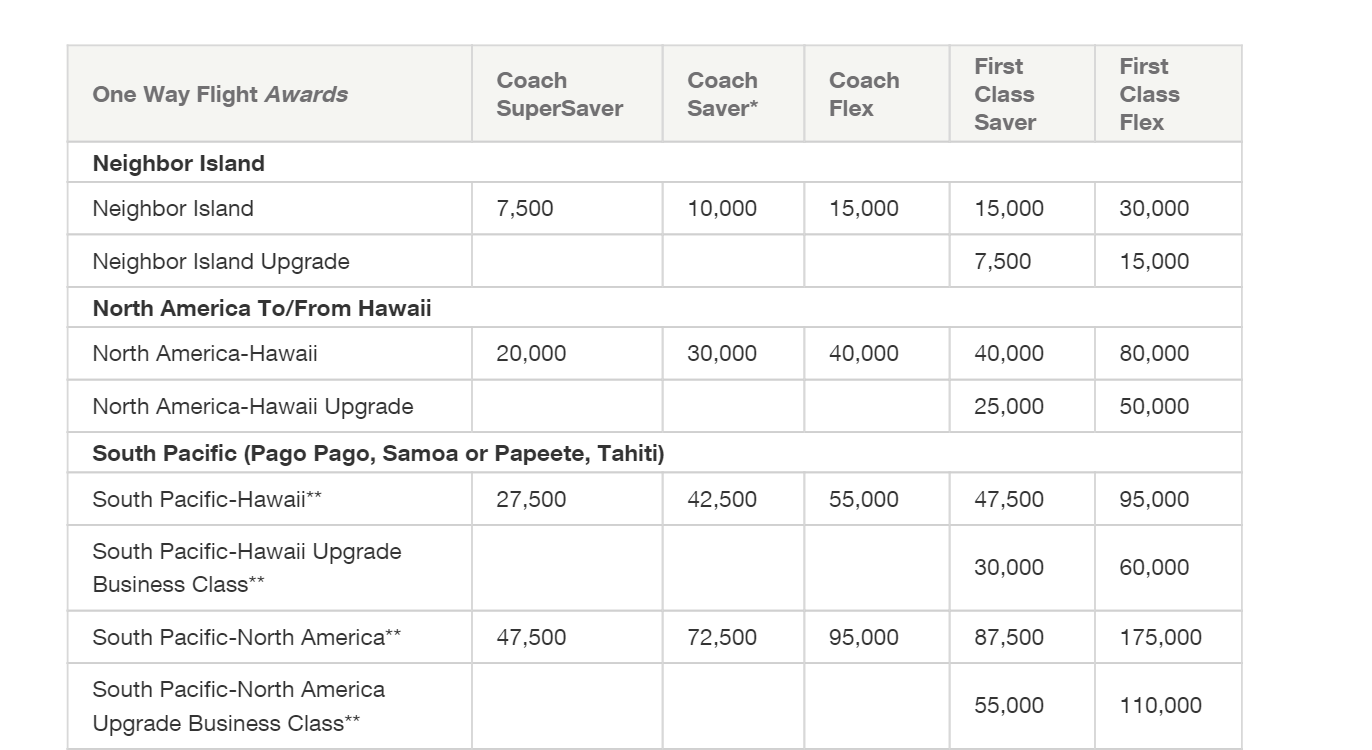

First, let’s take a look at the mileage required to travel to and from Hawaii from North America

The minimum one-way fare between islands is 7,500, and the minimum one-way fare from North America to Hawaii is 20,000.

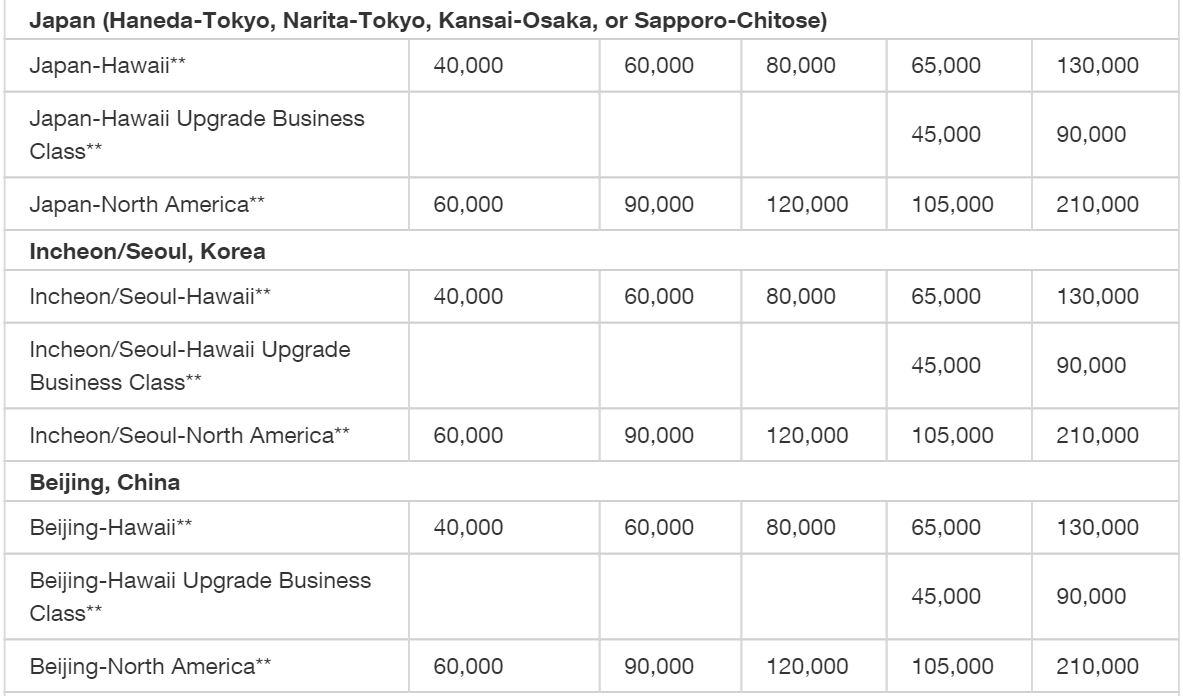

There are Hawaiian Airlines flights that fly directly to Hawaii from Beijing, Japan, South Korea and other places. The exchange chart is as follows.

HA mileage redemption partners also include ANA, Jetblue, Korean, Virgin America/Australia/Atlantic. Official Website.

Recommended application time

- Barclays places great emphasis on recent Hard Pulls and recommends applying when the number of Hard Pulls within 6 months is less than 6, although this is not a strict rule.

- [6/24 rule] Similar to Chase’s 5/24 rule, Barclays will also reject you if you have 6 or more new accounts within 24 months. However, unlike Chase, Barclays’ rule is not strictly enforced and there are often counter-examples.

- It is recommended that you apply after having a credit history of more than one year.

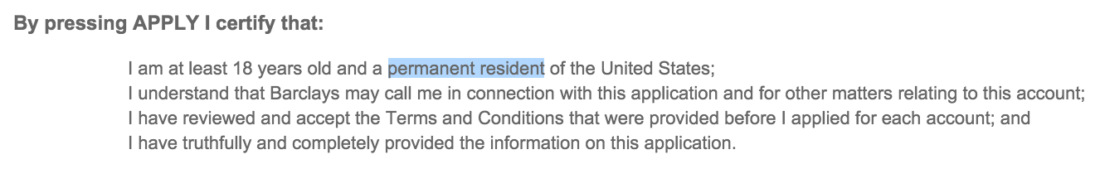

- Theoretically, only Permanent Residents (green card holders or citizens) can apply for Barclays credit cards. The screenshot below is from the application details. In fact, the bank does not really verify whether you are a green card holder or citizen. Non-green card holders can also apply, but at their own risk.

Summarize

If you have an urgent need for Hawaiian Airlines, want to take HA to Hawaii, or want to make full use of HA miles for intra-island flights, you can consider applying. The sign-up bonus is average, and the long-term holding experience is also average.

Related credit cards

- Barclaycard Hawaiian

- Barclaycard Hawaiian Business

After applying

- Barclays can check the status of your application Click here.

- Barclays reconsideration backdoor number: 866-408-4064. Barclays will like to ask you various questions in detail, so you must be confident about your personal situation and credit report. In addition, their reconsideration is likely to hard pull again, but they will also inform you in advance, so you can use your own discretion.

Sign-up bonus trend chart