Choice Privileges Visa Signature Card Choice Hotels International Credit Card Overview

[Updated 2023.2] This card is no longer available. In the future, Choice Hotel Group's co-branded credit card will be issued by Wells Fargo and is expected to be launched in May.News link here.

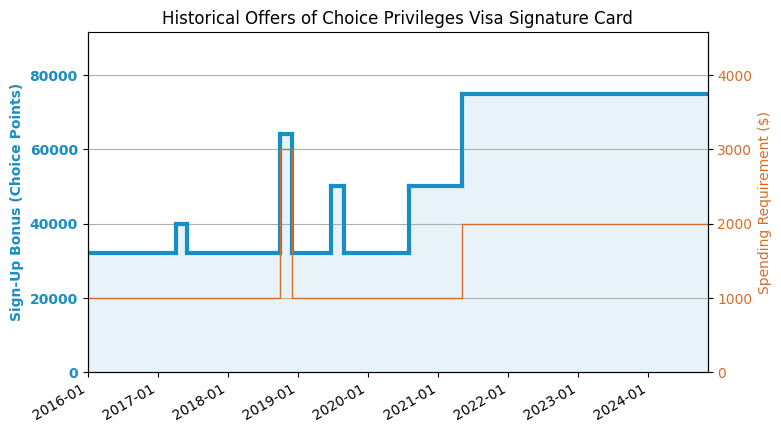

[Update 2021.5] A record high sign-up bonus of 75k has appeared.

Application Link

feature

- 75k sign-up bonus: earn 50,000 Choice Points after spending $1,000 or more within 90 days of account opening, and earn 25,000 Choice Points after spending $2,000 or more within 180 days of account opening. In addition, earn 2x points on all purchases in the first 12 months after account opening.This is the highest sign-up bonus for this card.

- The value of Choice Points is about 0.6 cents/point, so the highest sign-up bonus of 75k is worth about $450.

- You can earn 5x Choice Points on purchases at Choice (15x after adding the points you earn as a member), 5x on purchases of Choice GC or points, and 2x on other purchases.

- Earn 8,000 anniversary bonus points every year you spend $10,000 or more on purchases with your card by your account anniversary date.

- Get a 10% Points Bonus every time you purchase a stay with Choice Hotels.

- Enjoy Elite Gold status every time upon approval for the Choice Privileges Visa Card

- No annual fee.

shortcoming

- Foreign Transaction Fee (FTF) does exist, so don’t use it outside the United States.

Recommended application time

- Barclays places great emphasis on recent Hard Pulls and recommends applying when the number of Hard Pulls within 6 months is less than 6, although this is not a strict rule.

- [6/24 rule] Similar to Chase’s 5/24 rule, Barclays will also reject you if you have 6 or more new accounts within 24 months. However, unlike Chase, Barclays’ rule is not strictly enforced and there are often counter-examples.

- It is recommended that you apply after having a credit history of more than one year.

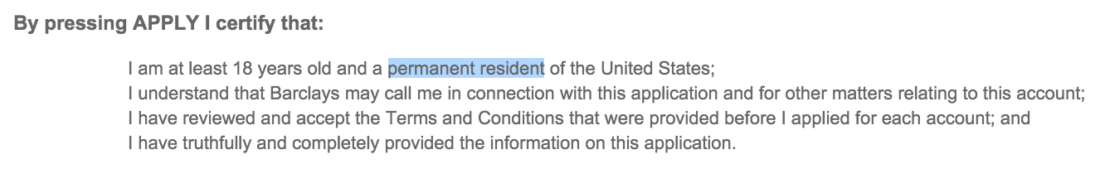

- Theoretically, only Permanent Residents (green card holders or citizens) can apply for Barclays credit cards. The screenshot below is from the application details. In fact, the bank does not really verify whether you are a green card holder or citizen. Non-green card holders can also apply, but at their own risk.

Summarize

As a card with no annual fee, this sign-up bonus is pretty good. This card is average in all aspects, and the Choice hotel group is basically low-end hotels, which is not very interesting. I recommend friends who don’t know much about it to pay attention to the credit cards of hotel groups such as Marriott Hyatt Hilton. However, if you are interested in the Choice group, you can still consider applying for one, after all, there is no annual fee and it is stress-free to hold.

After applying

- Barclays can check the status of your application Click here.

- Barclays reconsideration backdoor number: 866-408-4064. Barclays will like to ask you various questions in detail, so you must be confident about your personal situation and credit report. In addition, their reconsideration is likely to hard pull again, but they will also inform you in advance, so you can use your own discretion.

Sign-up bonus trend chart