American Express Green Card

[Updated 2024.10] This card previously had a benefit of $100 LoungeBuddy Credit per year, which has now been removed. Existing cardholders can enjoy this benefit until January 13, 2025. This move is not surprising because LoungeBuddy itself is about to be shut downThis makes it even more difficult to justify the annual fee of the AmEx Green card.

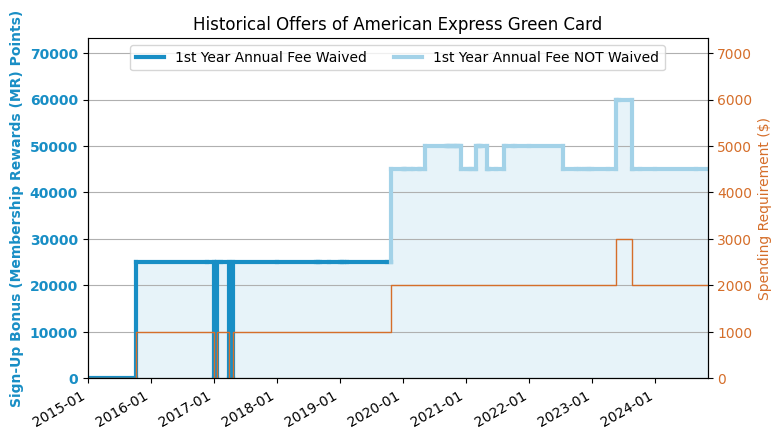

[2023.8 Update] Reliable news indicates that the 60k+$200 offer will expire on 8.23 (Wednesday), so hurry up if you need it. [Update] It has expired, and there is only a 40k sign-up bonus left.

[Updated in May 2023] Today, this card has released a new record-high sign-up bonus: 60k MR points for spending $3,000 within 6 months of opening the card, and 20% back for spending in the travel and transit categories within the first 6 months, up to $200 back (that is, $1,000 spending). Friends who are interested in this card can sign up now!

Application Link

feature

- 40k sign-up bonus: Earn 40,000 Membership Rewards (MR) points after spending $3,000 or more within 6 months of account opening!The highest sign-up bonus recently is 60k+$200.

- The points earned from this card are Membership Rewards (MR), and we estimate it to be 1.6 cents/point. See below for a brief introduction. Therefore, the 60k+$200 sign-up bonus is worth about $1,160!

- Earn 3x points on dining and travel (worldwide), and 1x on all other purchases.

- You can get $189 CLEAR membership fee reimbursement every calendar year. CLEAR is a service that allows you to quickly pass the ID check at the airport. This article.

You can get $100 LoungeBuddy reimbursement every calendar year.[Removed since 2024.10]- No Foreign Transaction Fee (FTF).

- This card can be used AmEx OfferThere are often some good merchant discounts, such as Walmart $15 return $5, such as Amazon $75 return $25.

- This card can Refer a friend: If you recommend this card to a friend and they apply successfully, you can earn 5k MR points for each successful application, up to a cap of 55k / calendar year.

- The application is easy because strictly speaking it is a charge card rather than a credit card. Charge card means that you cannot just pay the minimum payment, but must pay off the full balance before each due date. Please note that there will also be a hard pull when applying for a charge card, just like a credit card.

- Charge Cards have no pre-set spending limit.

shortcoming

- The annual fee is $150, and it is not waived in the first year.

Introduction to MR Points

- The main credit cards that can earn MR points are:AmEx ED, AmEx EDP, AmEx Green, AmEx Gold, AmEx Platinum, AmEx Platinum for Schwab, AmEx Platinum for Morgan Stanley, AmEx Blue Business Plus, AmEx Business Green, AmEx Business Gold, AmEx Business Platinum etc.

- The MR points accumulated from each MR card are automatically accumulated to the same MR account.

- MR points never expire. Closing a card will not cause the MR points accumulated on that card to disappear, but if you close all MR cards, all MR points will disappear. In order to avoid the loss of MR points, it is recommended that you hold a no-annual-fee card for a long time. AmEx ED.

- If you hold any MR card, you can convert MR into some airline miles. The most common and cost-effective way to use MR is to convert 1:1 into All Nippon Airways (ANA, NH) Miles (Star Alliance). Other recommended miles include: Air Canada(AC)(Star Alliance),Delta Air Lines(DL)(Trina),British Airways(BA)(Universe),Cathay Pacific Asia Miles(Universe),Singapore Airlines(SQ)(Star Alliance),Air France-KLM Flying Blue(Trina),Virgin Atlantic (VS)(Non-alliance) etc. If used this way, the points are worth about 1.6 cents/point.

- Holders of any MR card can directly redeem points at a fixed value of about 1 cent/point on AmEx travel portal Book your flight online.

- In holding AmEx Platinum for Schwab If you have the MR points card, you can redeem them at a fixed rate of 1.1 cents/point. If you don’t like to study miles, this is a good option. If you don’t have this card, you can only redeem MR points at a fixed rate of 0.6 cents/point.

- In summary, we estimate the value of MR points to be approximately 1.6 cents/point.

- For more information on the MR Points system, seeMaximize the value of your credit card points” (review) andHow to earn MR points》《MR Points Usage》(Super detailed).

Recommended application time

- You can only get the sign-up bonus once in a lifetime, so be sure to wait until the highest offer in history appears before applying!

- 【New】【Same series restrictions】AmEx has begun to gradually limit the sign-up bonuses of the same series of cards: the high annual fee will affect the low annual fee. Specifically, if you have opened a Gold or Platinum card with a high annual fee, it will affect the sign-up bonus of the Green card with a low annual fee, so if you want to get both, you can consider opening a Green card first.

- When you apply for a card, AmEx may pop up a window to inform you that you cannot get the sign-up bonus for this card because you have a bad relationship with AmEx. In this case, just use your existing AmEx card more often and try not to close it. It may be possible to wait for a while. For details, see "AmEx pop-up analysis》.

- AmEx is not sensitive to the number of Hard Pulls.

- You can apply if you have a credit history of more than six months.

Summarize

The point earning ability of this card has been greatly improved after the revision. 3x dining and travel are good rebate benefits, and the 45k MR sign-up bonus can also help you save a lot of points. The biggest problem is still the annual fee, which has increased from $95 to $150, but the reimbursement is not even as useful as the airline reimbursement of the Platinum and Gold cards, unless you really want to buy Away luggage, Clear membership or buy lounge access through LoungeBuddy. The point earning structure is also overlapped with the Gold card (both are dining multiple rebates). If you have a Gold card, then only 3x travel is the biggest attraction. Therefore, our suggestion is that it is worth considering the 45k MR sign-up bonus, but if you don’t have a lot of travel expenses or can’t use the reimbursement, it’s best to consider whether to hold it for a long time.

Considering that AmEx cards applied for on the same day can be combined with Hard Pull, and Charge Cards are not subject to application interval restrictions, you can bring this card along when applying for other AmEx credit cards. If you don't want to hold this card for a long time and haven't used up all your MR points before closing the account, you can apply for a no annual fee AmEx Everyday (ED) To preserve MR points for future redemption when needed.

Best downgrade option

- This card cannot be downgraded to a no annual fee card, so it is recommended to close it directly if you don’t want to keep it.

After applying

- AmEx application status check Click here.

- AmEx reconsideration backdoor number: 877-399-3083. American Express actually protects its real backdoor very well. Generally speaking, when you call it, the customer service there will help you submit various requests. Unlike Chase, you cannot directly contact the person with decision-making power.

Sign-up bonus trend chart